Top Industry Leaders in the Savory Snacks Market

Strategies Adopted by Savory Snacks Key Players

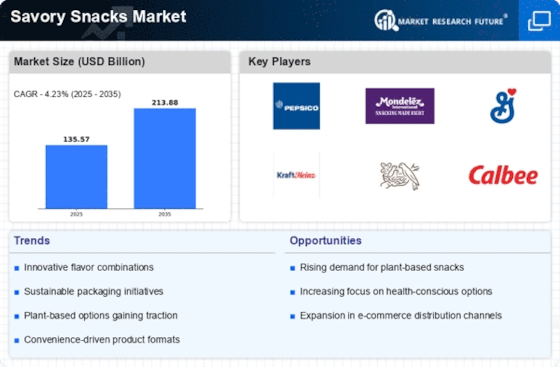

The Savory Snacks market, a significant segment within the global food and beverage industry, is characterized by a competitive landscape shaped by factors such as changing consumer preferences, the rising demand for convenient and on-the-go snacks, and the exploration of diverse flavor profiles. As of 2023, key players strategically position themselves in this environment, implementing various strategies to maintain or enhance their market share.

Key players in the Savory Snacks market deploy a range of strategies to remain competitive. Continuous investment in research and development is a central strategy, aimed at innovating snack formulations, exploring new flavors, and addressing health-conscious consumer trends, such as reduced sodium and clean-label products. Strategic acquisitions, mergers, and partnerships with other snack manufacturers contribute to expanding market reach and diversifying product offerings. Marketing efforts often focus on branding, packaging innovations, and promotional activities to maintain brand visibility and appeal to target demographics.

Market Share Analysis:Market share analysis in the Savory Snacks market is influenced by several factors, including brand recognition, product quality, pricing strategies, and distribution efficiency. Companies with strong brand equity and a wide variety of popular snack products tend to secure a larger market share. Pricing strategies that balance affordability with perceived value play a crucial role, especially considering the price sensitivity of consumers in this market. Efficient distribution networks, covering both traditional retail channels and emerging e-commerce platforms, are vital for maintaining a competitive edge.

New and Emerging Companies:

While key players dominate the Savory Snacks market, new and emerging companies are entering the sector, often focusing on specific niche markets or introducing innovative snack formulations. These entrants may emphasize health-centric ingredients, ethnic flavors, or cater to specific dietary preferences, contributing to the diversification and expansion of the overall savory snacks market. Although their market share may be relatively modest compared to industry leaders, these companies play a crucial role in driving innovation and responding to evolving consumer demands.

Industry Trends:The Savory Snacks market has witnessed noteworthy industry news and investment trends in 2023. Key players are investing in sustainability initiatives, emphasizing eco-friendly packaging materials and responsible sourcing practices to meet the growing demand for environmentally conscious products. Collaborations with local farmers and suppliers contribute to supporting regional economies and ensuring a consistent supply chain. Additionally, investments in technology adoption for production processes, such as advanced frying and seasoning techniques, aim to enhance product quality and improve efficiency in response to consumer expectations.

Competitive Scenario:

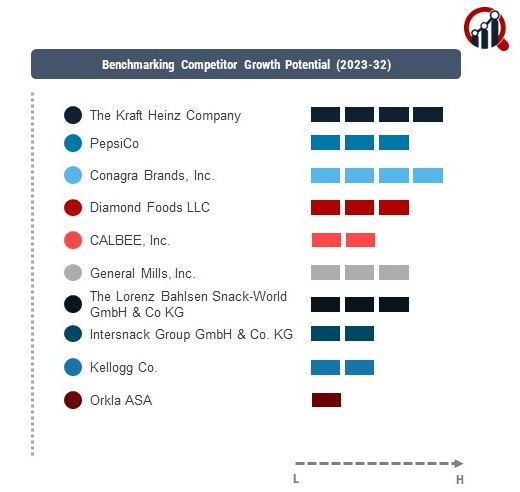

The overall competitive scenario in the Savory Snacks market is marked by intense rivalry among key players striving to capture a larger share of the growing market. The industry's competitiveness is evident in the emphasis on innovation, sustainability, and strategic collaborations to address evolving consumer preferences. The global reach of these companies enables them to adapt to regional tastes, capitalize on emerging markets, and navigate regulatory landscapes, contributing to the overall dynamism of the industry.

Recent Development in 2023:

In response to the growing demand for high-protein, plant-based snacks, Kellogg Co. introduced Special K® Protein Bites and Plant-Based Protein Bars.General Mills Inc.: Presented Old El PasoTM Homestyle Bean Dips, a wholesome substitute for regular dips that has more fibre and protein.

Key Players:

Kraft Heinz CompanyPepsiCoDiamond Foods LLCCALBEE Inc.JACK Link’s LLC.Orkla ASAConagra Brands Inc.Intersnack Group GmbH & Co. KGKellogg Co.Mondelez InternationalHain Celestial GroupNestle SAITC LimitedGeneral Mills Inc.