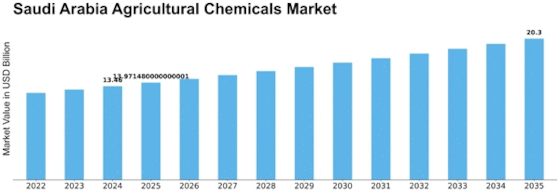

Saudi Arabia Agricultural Chemicals Size

Saudi Arabia Agricultural Chemicals Market Growth Projections and Opportunities

There are several key market issues that have an impact on the performance of the Saudi Agricultural Chemicals Market indicating certain directions of the market. The major factor responsible for the growing market is the fast developing demands for food products which the increasing population and varieties in the diets. A rate of population growth entails the need for intensive farming to increase farm output and help with food availability. This demand drives the application of production chemicals, mainly fertilizers, pesticides, and herbicides, to enhance the crops productivity and to offer protection to the crops against the attacks by infectious organisms.

However, government policies and regulations form the foundation of the market modulation in Saudi Arabia Agricultural Chemicals industry. Interest of the government in agriculture sector, fighting harmful effects of farming methods on environment and environment itself provide opportunities to mitigate greenhouse effect. The driven forces for success of these chemicals in the market is the regulatory frameworks and guidelines, that affect the strategy of the players in the market and their product offerings.

In the kingdom of Saudi Arabia, the presence of new technologies in agriculture is the main cause for the expansion of the agricultural chemicals’ market. The precision in agriculture includes the application of drones for aerial surveys, satellite scanning for soil and other area data, use of sensors and control systems for smart irrigation and precision application of inputs. Farmers, especially those pursuing the agriculture in future, are adopting the latest technologies into their operations so that they can have the highest yield possible as well as the best resource utilization. Thus, they are creating the very background in which it is absolutely necessary to have advanced chemicals in agriculture.

As a result of ECM , global economic factors, such as commodity prices and trade policies, significantly impacts Agricultural Chemicals Market in Saudi Arabia. The changing of commodity prices for main farming goods even determine the way farmers do things and may make them shift to the cheaper chemicals for agriculture. Along with this, international trade agreements and policies may thus change the availability and the price of pesticides, insecticides, etc…in the Kingdom of Saudi Arabia.

Environmental risks and sustainability problems, which have got a higher priority in the agricultural sector, force the farmers and chemical companies making lot of greenish decisions. Farming today is not about greening but polluting the environment mainly with chemicals, thus, a consciousness is fostering and eco-friendly pesticides and fertilizers are preferred.

Climate variability and change are theˈpanel« factors that put the bullsˈeye on the Saudi Arabia Agricultural Chemical Market. The phenomena such as rise or fall of temperature, altered precipitatiuon patterns and water availability concern yields and type of chemicals in agriculture.

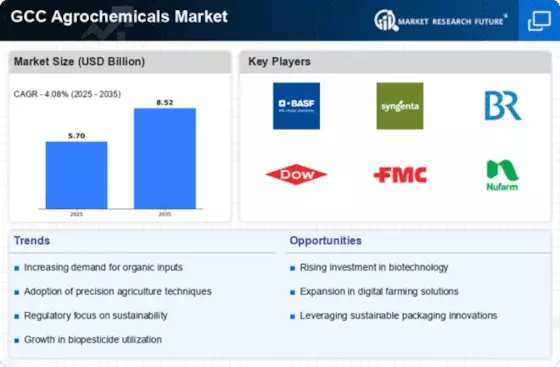

Market competition and significant players influence in the agricultural chemicals market draw an agricultural chemical industry picture in Saudi Arabia. The area is characterized by the existence of the big and the small player, the multinationals and the small scale manufacturers, the local producers, and the distributors. Rivalry, a main catalysing factor in the industry, promotes the need to be innovative while companies work hard to differentiate and market their products.

Leave a Comment