Market Analysis

In-depth Analysis of Satellite Propulsion System Market Industry Landscape

The Satellite Propulsion System Market is influenced by several key market factors that collectively shape its dynamics and growth trajectory. One of the primary factors is the increasing demand for satellite launches across various applications, including communication, Earth observation, navigation, and scientific research. The expanding satellite market, driven by the growing need for connectivity and data, influences market factors by creating a sustained demand for reliable and efficient satellite propulsion systems. As the number of satellite deployments rises globally, propulsion systems become integral components, contributing to market factors such as propulsion system development, manufacturing, and integration into satellite platforms.

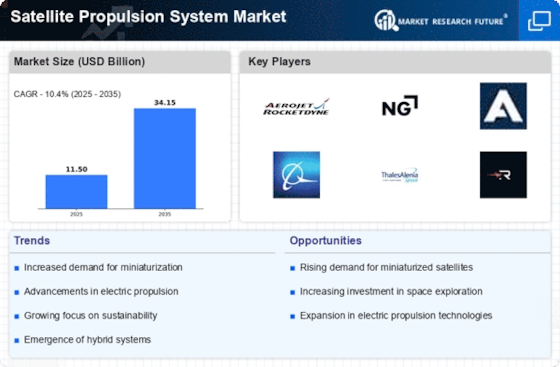

Blast off for a market boom! The satellite propulsion system market, currently orbiting at USD 1.5 billion, is set for a spectacular trajectory, projected to reach a staggering USD 8.98 billion by 2032 at a blistering 22.00% CAGR. Fueling this ascent are two powerful boosters: a surge in space exploration missions and a growing demand for solutions and services in the bustling "neighborhood" of Low Earth Orbit. So buckle up, because the future of satellites is looking brighter, faster, and further-reaching than ever before! Technological advancements represent a pivotal market factor in the Satellite Propulsion System Market. The evolution of propulsion technologies, particularly the development of electric propulsion systems such as ion and Hall-effect thrusters, is a significant factor influencing market dynamics. Manufacturers invest in research and development to enhance the efficiency, performance, and versatility of propulsion systems. Technological advancements contribute to market factors by offering solutions that align with the evolving requirements of satellite operators, providing propulsion systems that enable extended mission lifetimes, precise orbit control, and fuel efficiency.

The commercialization of space and the emergence of private space companies contribute to market factors in the Satellite Propulsion System Market. The increasing involvement of commercial entities in satellite launches and space exploration influences market dynamics by creating new opportunities and challenges. Market factors are shaped by the competition among private companies, as well as traditional space agencies, to develop and offer cost-effective, reliable propulsion systems that cater to the diverse needs of the satellite industry. The commercialization trend drives market factors such as innovation, cost optimization, and the exploration of new business models.

The trend toward miniaturization and the rise of small satellites represent crucial market factors. The demand for smaller, more affordable satellites, including CubeSats and nanosatellites, is growing. Market factors are influenced by the need for propulsion systems that are compact, lightweight, and tailored to the specific requirements of small satellite missions. The miniaturization trend contributes to market factors such as the development of micropropulsion technologies, enabling precise orbital maneuvers and enhancing the capabilities of small satellite constellations.

Regulatory initiatives and safety standards play a significant role as market factors in the Satellite Propulsion System Market. Governments and regulatory bodies, including the Federal Aviation Administration (FAA) and the European Space Agency (ESA), establish guidelines and standards for space activities, including satellite launches. Compliance with these regulations is crucial for manufacturers and operators, influencing market factors such as system certification, safety protocols, and adherence to environmental norms. Market factors are shaped by the need to meet regulatory requirements, ensuring that propulsion systems are designed and operated in accordance with established safety and environmental standards.

Global geopolitical trends contribute to market factors in the Satellite Propulsion System Market. The strategic positioning of satellite constellations for communication, Earth observation, and national security purposes is influenced by geopolitical considerations. Market factors include the demand for propulsion systems that support precise orbital placement, station-keeping, and maneuverability, aligning with the strategic objectives of nations and organizations. The competitive landscape is influenced by market factors such as regional preferences, alliances, and geopolitical dynamics that shape the distribution and deployment of satellite propulsion systems.

Environmental considerations and sustainability emerge as increasingly important market factors in the Satellite Propulsion System Market. The space industry is acknowledging the environmental impact of space activities, including propulsion system operations. Market factors are influenced by the development of green propulsion technologies that use non-toxic propellants or propellantless systems, aligning with the broader trend towards sustainable space practices. Manufacturers responding to this market factor contribute to the industry's commitment to responsible and environmentally conscious space exploration.

Research and development investments represent a critical market factor in the Satellite Propulsion System Market. Manufacturers actively engage in R&D initiatives to stay at the forefront of propulsion technology. Market factors include the pursuit of innovative solutions, materials, and design approaches that address emerging challenges and market trends. Research and development investments contribute to market factors by positioning companies competitively, fostering the advancement of propulsion technologies, and driving the industry's ability to address the evolving needs of satellite operators.

Leave a Comment