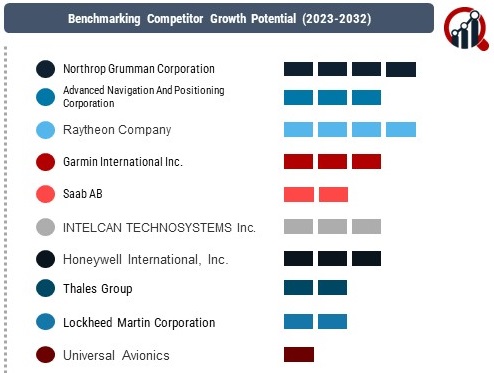

Top Industry Leaders in the Satellite Based Augmentation Systems Market

Key Players and Market Dynamics:

Northrop Grumman Corporation (US)

Advanced Navigation And Positioning Corporation (US)

Raytheon Company (US)

Garmin International Inc. (US)

Saab AB (Sweden)

INTELCAN TECHNOSYSTEMS Inc. (Canada)

Honeywell International, Inc.(US)

Thales Group (France)

Lockheed Martin Corporation (US)

Universal Avionics (US)

Strategies Adopted by Key Players:

To secure a robust position in the SBAS market, key players adopt diverse strategies that align with technological advancements and changing market demands. Continuous product development and innovation are common themes, with companies investing heavily in upgrading their satellite technologies to enhance accuracy and reliability. Collaboration and strategic partnerships are prevalent strategies, as seen in joint ventures between aerospace and technology companies to create comprehensive and integrated SBAS solutions.

Market leaders also focus on expanding their global footprint through acquisitions and mergers, enabling them to tap into new markets and diversify their service offerings. These strategic moves allow companies to strengthen their position in the value chain and cater to a broader customer base. Moreover, market leaders actively engage in government contracts, aligning with national initiatives to bolster satellite infrastructure and navigation capabilities.

Factors for Market Share Analysis:

Market share analysis in the SBAS sector considers various factors that impact the competitive positioning of companies. Technological innovation, product performance, pricing strategies, and the ability to meet evolving customer requirements are key determinants. The reliability and accuracy of SBAS solutions play a pivotal role in influencing market share, as end-users prioritize systems that provide precise positioning data.

Government regulations and standards also contribute significantly to market share dynamics. Compliance with international standards and certifications enhances a company's credibility and fosters trust among customers. Additionally, factors such as global partnerships, customer service, and the ability to customize solutions for specific industries contribute to a company's market share in the SBAS market.

New and Emerging Companies:

The SBAS market is witnessing a surge in new and emerging companies that focus on niche technologies and specialized applications. Start-ups like SkyLabs and Swift Navigation are gaining attention for their innovative approaches to SBAS, introducing solutions tailored for sectors like agriculture, logistics, and autonomous vehicles. These companies leverage cutting-edge technologies, including artificial intelligence and machine learning, to enhance the performance of satellite-based navigation systems.

The emergence of smaller players contributes to market dynamism, fostering competition and driving established companies to stay at the forefront of innovation. Venture capital investments in these start-ups indicate a growing interest in the potential of SBAS technologies to revolutionize various industries beyond traditional aerospace and defense applications.

Industry News and Trends:

Keeping abreast of industry news and trends is essential for understanding the competitive landscape of the SBAS market. Recent developments include the integration of SBAS with emerging technologies such as 5G and the Internet of Things (IoT), expanding the scope of applications beyond traditional navigation. Industry partnerships and collaborations, such as those between SBAS providers and telecommunication companies, signal a shift towards more integrated and interconnected solutions.

Moreover, advancements in satellite technology, such as the deployment of next-generation satellites with improved capabilities, impact the competitive dynamics. Industry trends also highlight the increasing demand for real-time and high-precision positioning, prompting companies to invest in solutions that meet these evolving customer expectations.

Current Company Investment Trends:

Investment trends in the SBAS market reflect the industry's growth potential and the strategic priorities of key players. The sector is witnessing substantial investments in research and development, particularly in areas like signal processing algorithms, satellite miniaturization, and cybersecurity. Companies are allocating resources to enhance the resilience and security of SBAS against potential threats, addressing concerns related to system vulnerabilities.

Additionally, there is a noticeable trend of companies investing in sustainable and environmentally friendly technologies. This includes the development of energy-efficient satellites and eco-friendly manufacturing processes, aligning with broader corporate responsibility initiatives and environmental regulations.

Overall Competitive Scenario:

In conclusion, the competitive landscape of the Satellite-Based Augmentation Systems market is characterized by a blend of established aerospace and defense giants, nimble technology-focused start-ups, and strategic collaborations that shape the industry's trajectory. Key players are leveraging innovative technologies, strategic partnerships, and global expansion to maintain their competitive edge. Market dynamics are influenced by factors such as technological advancements, regulatory compliance, and the ability to meet evolving customer demands.

As the market continues to evolve, staying attuned to industry news, investment trends, and emerging technologies will be crucial for companies seeking to navigate the complexities of the SBAS sector. The convergence of SBAS with other transformative technologies and the emergence of new players underscore the dynamic nature of the market, presenting both challenges and opportunities for companies vying for a significant share in this rapidly growing industry.

Recent News :

Lockheed Martin:

October 26, 2023: Announced a contract with the European GNSS Agency (GSA) to provide modernization services for the Galileo satellite navigation system, including improvements to its SBAS component, EGNOS.

Raytheon Technologies:

December 12, 2023: Successfully launched two new satellites for the Wide Area Augmentation System (WAAS), further strengthening the coverage and accuracy of the US SBAS system.

Thales Alenia Space:

April 25, 2023: Achieved a major milestone in the Galileo program by integrating a new satellite into the system's Ground Mission Segment (GMS), enhancing SBAS services for over 3 billion users worldwide.

Japan Aerospace Exploration Agency (JAXA):

November 8, 2023: Successfully launched the Michibiki-7 satellite, expanding the coverage and capabilities of the Quasi-Zenith Satellite System (QZSS), Japan's regional SBAS.

Indian Space Research Organisation (ISRO):

October 31, 2023: Conducted successful trials of the GAGAN (GPS Aided GEO Augmented Navigation) system at Kishangarh Airport in Rajasthan, demonstrating the effectiveness of India's indigenous SBAS technology.