Rising Importance of Predictive Analytics

The rising importance of predictive analytics is emerging as a crucial driver for the Sales Analytics Software Market. Businesses are increasingly seeking tools that not only analyze historical data but also forecast future trends and behaviors. Predictive analytics enables organizations to anticipate customer needs, optimize sales strategies, and allocate resources more effectively. Current market trends indicate that predictive analytics could enhance sales performance by as much as 20% for companies that implement these tools effectively. As the competitive landscape intensifies, the ability to leverage predictive insights will likely become a key differentiator for businesses. Consequently, the demand for sales analytics software that incorporates predictive capabilities is expected to grow, further stimulating market expansion.

Advancements in Cloud Computing Technology

Advancements in cloud computing technology are significantly influencing the Sales Analytics Software Market. The shift towards cloud-based solutions offers businesses greater flexibility, scalability, and cost-effectiveness. As organizations increasingly migrate their operations to the cloud, the demand for cloud-based sales analytics software is expected to rise. Current estimates suggest that the cloud segment of the sales analytics market could account for over 60% of total market revenue by 2026. This transition allows companies to access real-time data and analytics from anywhere, facilitating informed decision-making. Furthermore, the ability to integrate various data sources into a single platform enhances the analytical capabilities of sales teams, making cloud technology a pivotal driver of market growth.

Integration of Multi-Channel Sales Strategies

The integration of multi-channel sales strategies is driving the Sales Analytics Software Market as businesses seek to optimize their sales efforts across various platforms. With the proliferation of e-commerce, social media, and traditional retail, companies are increasingly adopting a multi-channel approach to reach customers. This complexity necessitates advanced analytics tools that can provide insights into performance across different channels. Research suggests that organizations employing multi-channel strategies can achieve up to 30% higher customer engagement rates. As businesses strive to understand the effectiveness of their sales channels, the demand for sales analytics software that can analyze data from multiple sources is likely to increase. This trend underscores the importance of comprehensive analytics solutions in navigating the evolving sales landscape.

Growing Demand for Data-Driven Decision Making

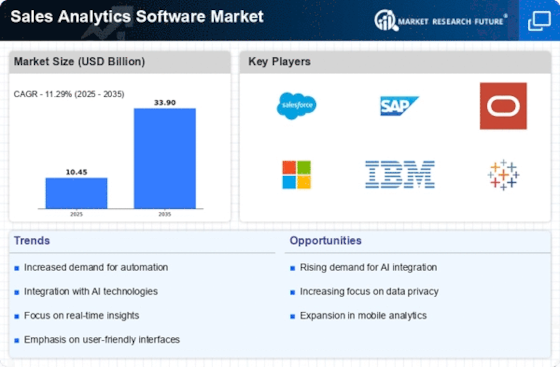

The increasing emphasis on data-driven decision making is a primary driver for the Sales Analytics Software Market. Organizations are recognizing the value of leveraging data to inform their strategies and operations. According to recent statistics, companies that utilize data analytics are 5 times more likely to make faster decisions than their competitors. This trend is pushing businesses to adopt sales analytics software that can provide insights into customer behavior, sales trends, and market dynamics. As a result, the demand for sophisticated analytics tools is expected to rise, with the market projected to grow at a compound annual growth rate of 12% over the next five years. This growth reflects a broader shift towards integrating analytics into everyday business processes, thereby enhancing overall performance.

Increased Focus on Customer Relationship Management

The Sales Analytics Software Market is experiencing a surge in demand due to the heightened focus on customer relationship management (CRM). Businesses are increasingly investing in tools that enable them to analyze customer interactions and improve engagement strategies. Research indicates that organizations utilizing sales analytics software can enhance customer retention rates by up to 25%. This is particularly relevant as companies strive to build long-term relationships with their clients. The integration of sales analytics with CRM systems allows for a more comprehensive understanding of customer needs and preferences, thereby driving sales growth. As companies continue to prioritize customer satisfaction, the adoption of sales analytics software is likely to expand, further propelling market growth.