Rising Demand for Automation

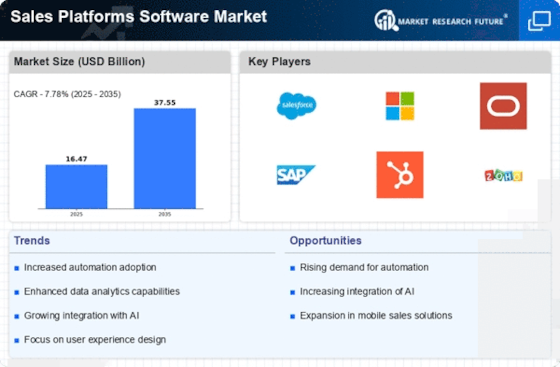

The Sales Platforms Software Market is experiencing a notable surge in demand for automation solutions. Businesses are increasingly seeking to streamline their sales processes, reduce manual tasks, and enhance efficiency. Automation tools within sales platforms enable organizations to manage leads, track customer interactions, and analyze sales data with minimal human intervention. According to recent data, the automation segment within the sales software market is projected to grow at a compound annual growth rate of approximately 15% over the next five years. This trend indicates a shift towards more sophisticated sales strategies, where automation plays a pivotal role in driving productivity and improving sales outcomes.

Increased Focus on Data Analytics

Data analytics has emerged as a critical driver in the Sales Platforms Software Market. Organizations are increasingly leveraging data-driven insights to inform their sales strategies and decision-making processes. The ability to analyze customer behavior, sales trends, and market dynamics allows businesses to tailor their approaches and optimize performance. Recent statistics suggest that companies utilizing advanced analytics tools within their sales platforms have reported up to a 20% increase in sales effectiveness. This emphasis on data analytics not only enhances forecasting accuracy but also empowers sales teams to identify opportunities and mitigate risks more effectively.

Emergence of Mobile Sales Solutions

The proliferation of mobile technology is reshaping the Sales Platforms Software Market, as businesses increasingly adopt mobile sales solutions. These platforms empower sales teams to access critical information and manage customer interactions on-the-go, enhancing responsiveness and productivity. Recent data suggests that mobile sales applications can improve sales team efficiency by up to 25%. This trend highlights the necessity for sales platforms to offer mobile compatibility, ensuring that organizations can leverage the advantages of mobility in their sales processes.

Shift Towards Subscription-Based Models

The Sales Platforms Software Market is witnessing a significant shift towards subscription-based pricing models. This transition allows businesses to access advanced sales tools without the burden of hefty upfront costs. Subscription models provide flexibility and scalability, enabling organizations to adapt their sales platforms according to evolving needs. Recent market analysis indicates that subscription-based sales software is expected to account for over 60% of the total market share by 2026. This trend reflects a broader movement towards more agile and cost-effective solutions, aligning with the preferences of modern businesses.

Growing Importance of Customer Relationship Management

Customer Relationship Management (CRM) systems are integral to the Sales Platforms Software Market, as they facilitate the management of customer interactions and relationships. The increasing recognition of the value of customer-centric approaches has led to a heightened demand for CRM-integrated sales platforms. Research indicates that organizations employing robust CRM solutions experience a 30% improvement in customer retention rates. This trend underscores the necessity for sales platforms to incorporate CRM functionalities, enabling businesses to foster long-term relationships with clients and enhance overall sales performance.