Collaboration Among Stakeholders

Collaboration among various stakeholders, including governments, NGOs, and private sector entities, appears to be a crucial driver for the RUTF and RUSF Market. Partnerships that focus on addressing malnutrition through comprehensive strategies are becoming more prevalent. These collaborations often involve sharing resources, knowledge, and best practices to enhance the effectiveness of nutritional programs. For example, joint initiatives that combine the expertise of healthcare providers with the logistical capabilities of private companies can lead to more efficient distribution of RUTF and RUSF Market. This synergy not only improves access to these products but also fosters innovation in their development. As stakeholders continue to work together, the RUTF and RUSF Market is likely to benefit from increased investment and a more coordinated approach to tackling malnutrition.

Government Initiatives and Funding

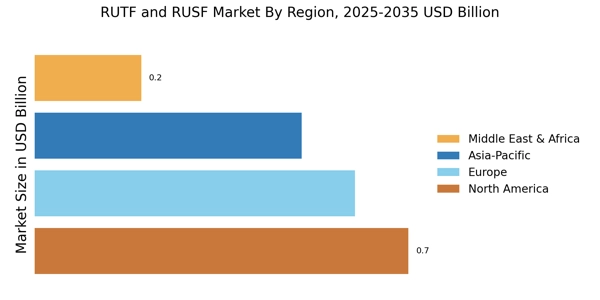

Government initiatives aimed at addressing malnutrition and improving food security are likely to bolster the RUTF and RUSF Market. Various countries have implemented policies that prioritize nutritional support for at-risk populations, often backed by substantial funding. For instance, national programs that distribute RUTF and RUSF Market in schools and healthcare facilities have been established in several regions. This financial commitment not only enhances the availability of these products but also raises awareness about their importance in combating malnutrition. Furthermore, international organizations are increasingly collaborating with governments to provide resources and technical assistance, which may further stimulate market growth. The RUTF and RUSF Market stands to benefit from these initiatives, as they create a conducive environment for the production and distribution of these vital nutritional products.

Increasing Prevalence of Malnutrition

The rising prevalence of malnutrition, particularly in vulnerable populations such as children and pregnant women, appears to be a primary driver for the RUTF and RUSF Market. According to recent data, malnutrition affects millions worldwide, with an estimated 149 million children under five years old experiencing stunted growth. This alarming statistic underscores the urgent need for effective nutritional interventions. As governments and NGOs intensify their efforts to combat malnutrition, the demand for ready-to-use therapeutic foods (RUTF) and ready-to-use supplementary foods (RUSF) is likely to surge. The RUTF and RUSF Market is thus positioned to expand significantly, as these products are essential in treating severe acute malnutrition and preventing moderate malnutrition, respectively. This trend suggests a growing recognition of the importance of nutrition in public health initiatives.

Rising Awareness of Nutritional Needs

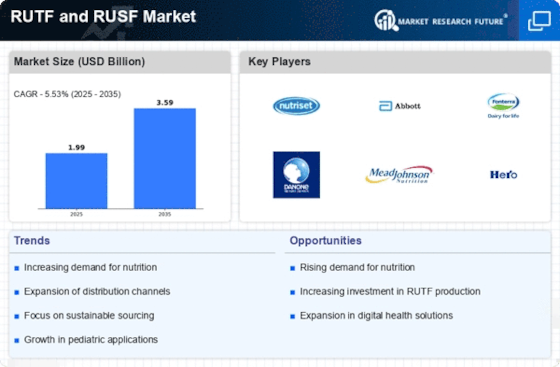

There appears to be a growing awareness of the nutritional needs of vulnerable populations, which is likely to drive the RUTF and RUSF Market. As public health campaigns and educational programs highlight the consequences of malnutrition, more stakeholders are recognizing the critical role of RUTF and RUSF Market in addressing these issues. This heightened awareness is reflected in increased demand from healthcare providers, NGOs, and governments seeking effective solutions to combat malnutrition. Market data indicates that the demand for RUTF and RUSF Market has been steadily increasing, with projections suggesting a compound annual growth rate (CAGR) of over 10% in the coming years. This trend indicates that the RUTF and RUSF Market is not only responding to immediate needs but is also evolving to meet the long-term nutritional requirements of at-risk populations.

Technological Advancements in Production

Technological advancements in the production of RUTF and RUSF Market are likely to enhance the efficiency and quality of these products, thereby driving the RUTF and RUSF Market. Innovations in food processing, packaging, and preservation techniques have the potential to improve the nutritional profile and shelf life of these foods. For instance, the development of new formulations that incorporate a wider range of nutrients can make RUTF and RUSF Market more effective in treating malnutrition. Additionally, advancements in supply chain management and distribution logistics may facilitate better access to these products in remote areas. As a result, the RUTF and RUSF Market could experience significant growth, as improved production methods lead to increased availability and affordability of these essential nutritional interventions.