Increasing Health Awareness

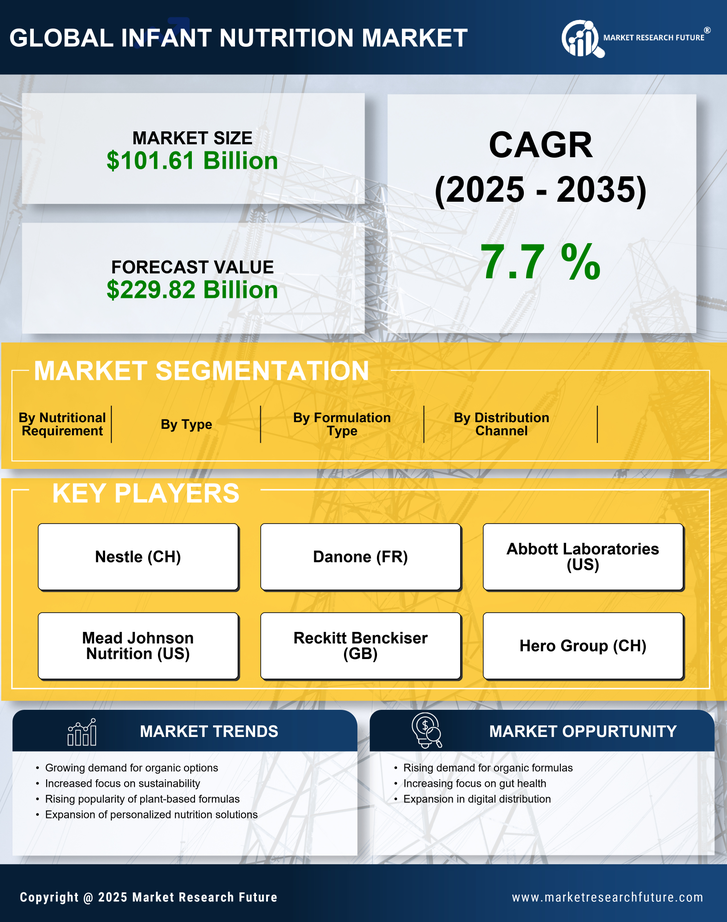

The rising health consciousness among parents appears to be a pivotal driver in the infant nutrition Market. Parents are increasingly seeking products that are not only nutritious but also free from harmful additives. This trend is reflected in the growing demand for organic and natural infant formulas, which has seen a notable increase in market share. According to recent data, the organic segment of the infant nutrition market has expanded significantly, indicating a shift towards healthier options. This heightened awareness is likely to continue influencing purchasing decisions, as parents prioritize the well-being of their children. Consequently, manufacturers are compelled to innovate and reformulate their products to align with these health trends, thereby enhancing their competitive edge in the Infant Nutrition Market.

Growing Demand for Convenience Products

The growing demand for convenience products is reshaping the Infant Nutrition Market. Busy lifestyles and the increasing number of working parents have led to a preference for ready-to-use and easy-to-prepare infant nutrition options. Products such as pre-packaged meals and single-serve formulas are gaining popularity, as they offer practicality without compromising on nutrition. Market analysis indicates that this segment is expanding rapidly, driven by the need for time-saving solutions. Manufacturers are responding by innovating packaging and product formats to cater to this demand. As convenience continues to be a priority for parents, it is likely that the Infant Nutrition Market will see further developments in this area, enhancing accessibility and usability for consumers.

Rising Birth Rates in Emerging Economies

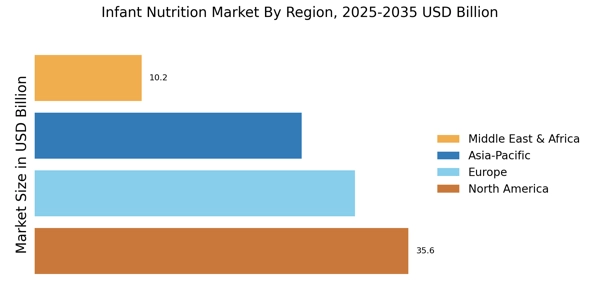

The increase in birth rates in emerging economies is a significant driver for the Infant Nutrition Market. Countries experiencing demographic shifts are witnessing a surge in demand for infant nutrition products. This trend is particularly evident in regions where economic growth is leading to improved living standards and increased disposable income. As families grow, the need for high-quality infant nutrition becomes paramount, prompting parents to invest in premium products. Market data suggests that regions with rising birth rates are expected to contribute substantially to the overall growth of the infant nutrition sector. Consequently, manufacturers are likely to focus their marketing strategies on these emerging markets to capitalize on the expanding consumer base.

Government Regulations and Safety Standards

Government regulations and safety standards play a crucial role in shaping the Infant Nutrition Market. Regulatory bodies are increasingly implementing stringent guidelines to ensure the safety and quality of infant nutrition products. These regulations are designed to protect infants from potential health risks associated with substandard products. Compliance with these standards not only enhances consumer trust but also drives manufacturers to invest in quality assurance processes. As a result, companies that adhere to these regulations may gain a competitive advantage in the market. Furthermore, the emphasis on transparency in labeling and ingredient sourcing is likely to influence consumer preferences, pushing brands to prioritize compliance in their product offerings within the Infant Nutrition Market.

Technological Advancements in Product Development

Technological innovations in product development are transforming the Infant Nutrition Market. Advances in food technology have enabled the creation of specialized formulas that cater to specific dietary needs, such as lactose intolerance or allergies. These innovations not only enhance the nutritional profile of infant products but also improve their digestibility and absorption. For instance, the introduction of hydrolyzed protein formulas has gained traction among parents seeking alternatives for sensitive infants. Furthermore, the integration of digital platforms for product information and consumer engagement is reshaping how parents make informed choices. As technology continues to evolve, it is likely to play a crucial role in shaping the future landscape of the Infant Nutrition Market.