Rising Geopolitical Tensions

The current geopolitical climate has heightened the demand for advanced military technologies, including remote weapon-stations. Russia's strategic positioning and ongoing conflicts in neighboring regions have necessitated the enhancement of its military capabilities. This situation has led to an increased focus on remote weapon systems, which provide operational flexibility and reduced risk to personnel. The remote weapon-stations market is expected to expand as military planners prioritize systems that can be deployed in high-risk environments. Analysts suggest that the market could see growth rates of up to 15% annually as the demand for these systems rises in response to evolving security challenges.

Emphasis on Autonomous Systems

There is a notable shift towards the integration of autonomous systems within the Russian military framework, which significantly influences the remote weapon-stations market. The development of unmanned platforms that can operate remotely is becoming a priority, as these systems enhance operational efficiency and reduce human involvement in dangerous situations. The remote weapon-stations market is likely to see innovations that incorporate artificial intelligence and machine learning, allowing for improved targeting and decision-making capabilities. This trend may lead to a competitive edge for Russia in modern warfare, as autonomous systems are increasingly viewed as essential components of future military strategies.

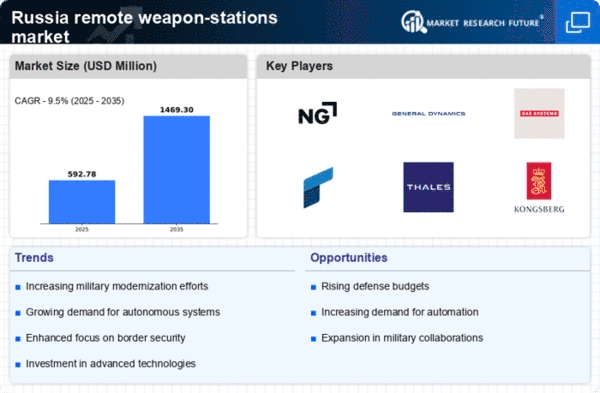

Growing Defense Budget Allocations

The Russian government has been increasing its defense budget, which has a direct impact on the remote weapon-stations market. In recent years, allocations have risen by approximately 10% annually, reflecting a strategic emphasis on modernizing military capabilities. This trend indicates a commitment to enhancing the technological prowess of the armed forces, particularly in remote weapon systems. The remote weapon-stations market is likely to benefit from this increased funding, as it allows for the procurement of advanced systems that can operate in diverse combat scenarios. Furthermore, the focus on domestic production of military equipment may lead to a surge in local manufacturers entering the remote weapon-stations market, thereby fostering competition and innovation within the industry.

Strategic Partnerships and Collaborations

The remote weapon-stations market is witnessing an increase in strategic partnerships between Russian defense contractors and international technology firms. These collaborations aim to leverage advanced technologies and enhance the capabilities of remote weapon systems. By pooling resources and expertise, these partnerships can accelerate the development of innovative solutions tailored to the specific needs of the Russian military. This trend may lead to a more competitive landscape within the remote weapon-stations market, as companies strive to deliver cutting-edge products. Furthermore, such collaborations could facilitate knowledge transfer and foster a culture of innovation, ultimately benefiting the overall defense industry in Russia.

Increased Focus on Urban Warfare Capabilities

As urban warfare becomes more prevalent, the need for specialized military equipment, including remote weapon-stations, is growing. The Russian military is adapting its strategies to address the complexities of combat in urban environments, where traditional warfare tactics may not be effective. This shift is driving demand for remote weapon systems that can provide precision fire support while minimizing collateral damage. The remote weapon-stations market is expected to expand as military planners seek to equip their forces with systems capable of operating effectively in densely populated areas. This trend may result in a diversification of product offerings within the market, catering to the unique challenges posed by urban combat scenarios.