Russia Graphite Market Summary

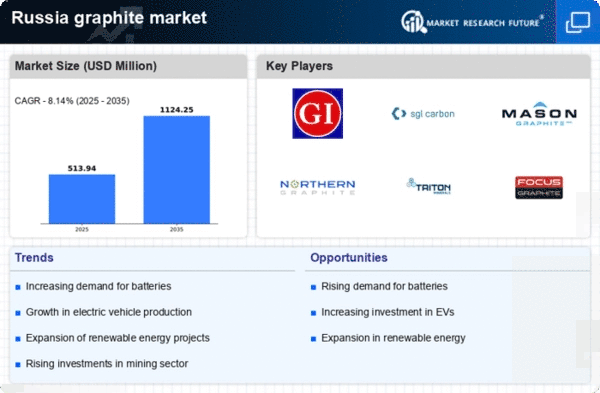

As per Market Research Future analysis, the Russia graphite market Size was estimated at 475.25 $ Million in 2024. The Russia graphite market is projected to grow from 513.94 $ Million in 2025 to 1124.25 $ Million by 2035, exhibiting a compound annual growth rate (CAGR) of 8.1% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Russia graphite market is experiencing a robust upward trajectory driven by diverse applications and technological advancements.

- The demand for battery-grade graphite is rising sharply, reflecting the growing electric vehicle market.

- Investment in graphite mining infrastructure is increasing, particularly in the Siberian region, which is the largest producer.

- Sustainability and environmental regulations are shaping production practices, with a focus on reducing carbon footprints.

- Technological advancements in graphite production and rising demand from the automotive sector are key drivers of market growth.

Market Size & Forecast

| 2024 Market Size | 475.25 (USD Million) |

| 2035 Market Size | 1124.25 (USD Million) |

| CAGR (2025 - 2035) | 8.14% |

Major Players

Graphite India Limited (IN), SGL Carbon SE (DE), Mason Graphite Inc. (CA), Northern Graphite Corporation (CA), Triton Minerals Limited (AU), Focus Graphite Inc. (CA), Syrah Resources Limited (AU), Lomiko Metals Inc. (CA)