Shift Towards 5G Technology

The rollout of 5G technology in Russia is poised to transform the telecommunications landscape, thereby impacting the Ethernet switch market. The Russia Ethernet Switch Market is expected to benefit from the increased demand for high-speed connectivity that 5G networks promise. With 5G enabling faster data transmission and lower latency, there is a growing need for Ethernet switches that can support these enhanced capabilities. Telecommunications companies are likely to invest in upgrading their infrastructure to accommodate 5G, which will drive the demand for advanced Ethernet switches. This shift towards 5G technology not only presents opportunities for existing players but also encourages new entrants to innovate and develop solutions tailored to the requirements of next-generation networks.

Growing Adoption of IoT Devices

The proliferation of Internet of Things (IoT) devices in Russia is driving the demand for Ethernet switches. As industries increasingly integrate IoT solutions, the need for robust networking infrastructure becomes paramount. The Russia Ethernet Switch Market is witnessing a surge in demand for switches that can handle the increased data traffic generated by these devices. According to recent estimates, the number of connected IoT devices in Russia is projected to reach over 100 million by 2026, necessitating advanced Ethernet switches to ensure seamless connectivity and data transfer. This trend indicates a shift towards more sophisticated networking solutions, as businesses seek to optimize their operations through IoT technology. Consequently, manufacturers are likely to focus on developing Ethernet switches that cater specifically to the requirements of IoT applications, thereby enhancing their market presence.

Increased Focus on Network Security

As cyber threats become more sophisticated, the emphasis on network security is reshaping the Ethernet switch market in Russia. Organizations are increasingly prioritizing secure networking solutions to protect sensitive data and maintain operational integrity. The Russia Ethernet Switch Market is responding to this trend by integrating advanced security features into Ethernet switches. This includes capabilities such as network segmentation, intrusion detection, and secure access controls. The growing awareness of cybersecurity risks is prompting businesses to invest in Ethernet switches that not only provide connectivity but also enhance their security posture. As a result, manufacturers are likely to innovate and develop switches that address these security concerns, thereby positioning themselves favorably in the competitive landscape.

Rising Demand for Data Center Solutions

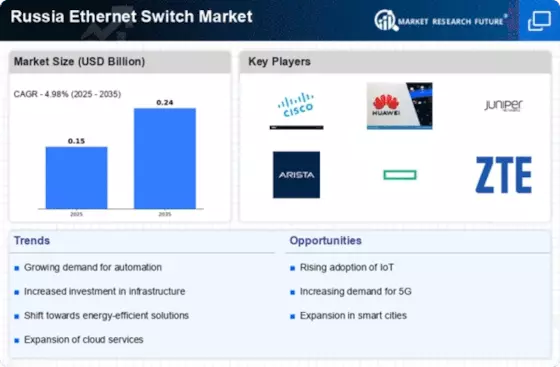

The expansion of data centers in Russia is a critical driver for the Ethernet switch market. With the increasing reliance on cloud computing and data storage solutions, the Russia Ethernet Switch Market is experiencing heightened demand for switches that can support large-scale data operations. Recent reports indicate that the data center market in Russia is expected to grow at a compound annual growth rate (CAGR) of over 10% through 2026. This growth is attributed to the rising need for efficient data management and processing capabilities. Consequently, Ethernet switches that offer high bandwidth, low latency, and scalability are becoming essential components of data center infrastructure. As businesses migrate to cloud-based solutions, the demand for advanced Ethernet switches is likely to continue its upward trajectory, presenting significant opportunities for market players.

Government Initiatives for Digital Transformation

The Russian government's commitment to digital transformation is significantly influencing the Ethernet switch market. Initiatives aimed at modernizing the country's digital infrastructure are creating a favorable environment for the Russia Ethernet Switch Market. The government has allocated substantial funding for the development of smart cities and digital services, which inherently require advanced networking solutions. For instance, the Digital Economy program aims to enhance connectivity across various sectors, including healthcare, education, and transportation. This push for modernization is expected to drive the demand for high-performance Ethernet switches that can support the growing data needs of these sectors. As a result, companies operating in the Ethernet switch market are likely to benefit from increased investments and opportunities arising from these government initiatives.