Shift Towards 5G Technology

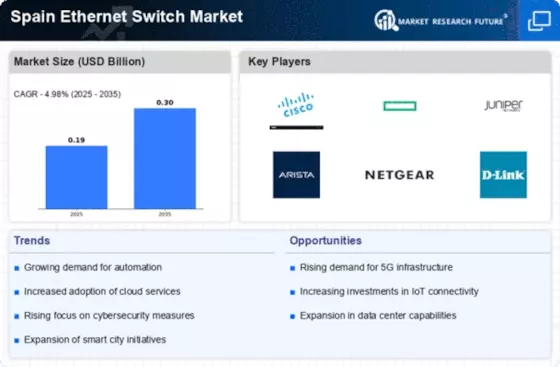

The transition to 5G technology in Spain is poised to revolutionize the telecommunications landscape, thereby impacting the Ethernet switch market. As 5G networks roll out, there is a growing need for Ethernet switches that can support higher speeds and lower latency. The Spain Ethernet Switch Market is likely to benefit from this shift, as businesses and service providers seek to upgrade their infrastructure to accommodate the demands of 5G. Analysts predict that the deployment of 5G will create new opportunities for Ethernet switch manufacturers, as the need for high-performance networking solutions becomes increasingly critical in a 5G-enabled environment.

Expansion of IoT Applications

The proliferation of Internet of Things (IoT) devices in Spain is significantly influencing the Ethernet switch market. With the rise of smart cities and connected devices, there is an increasing need for efficient data management and communication. The Spain Ethernet Switch Market is adapting to this trend by offering switches that can support a multitude of IoT devices, ensuring seamless connectivity and data transfer. It is estimated that the number of IoT devices in Spain will reach over 50 million by 2026, creating a substantial demand for Ethernet switches that can handle the increased network traffic and provide the necessary bandwidth.

Rising Cybersecurity Concerns

As cybersecurity threats continue to evolve, organizations in Spain are prioritizing secure networking solutions. The Spain Ethernet Switch Market is responding to this need by integrating advanced security features into Ethernet switches. These features include network segmentation, access control, and threat detection capabilities. With the increasing frequency of cyberattacks, businesses are investing in Ethernet switches that not only provide connectivity but also enhance their security posture. It is projected that the cybersecurity market in Spain will grow significantly, further driving the demand for secure Ethernet switching solutions that can protect sensitive data and maintain network integrity.

Growing Adoption of Cloud Services

The increasing adoption of cloud services in Spain is driving the demand for Ethernet switches. As businesses migrate their operations to the cloud, the need for robust networking infrastructure becomes paramount. The Spain Ethernet Switch Market is witnessing a surge in demand for switches that can handle high data throughput and provide reliable connectivity. According to recent data, the cloud computing market in Spain is projected to grow at a compound annual growth rate of over 20% in the coming years. This trend necessitates the deployment of advanced Ethernet switches to support cloud-based applications and services, thereby enhancing overall network performance and reliability.

Investment in Telecommunications Infrastructure

Spain's ongoing investment in telecommunications infrastructure is a key driver for the Ethernet switch market. The government and private sector are collaborating to enhance network capabilities, particularly in rural areas. This initiative is expected to bolster the Spain Ethernet Switch Market as new projects require advanced switching solutions to support enhanced connectivity. Recent reports indicate that investments in telecommunications infrastructure are set to exceed 10 billion euros by 2026, which will likely lead to increased demand for Ethernet switches that can accommodate higher data rates and improved network reliability.