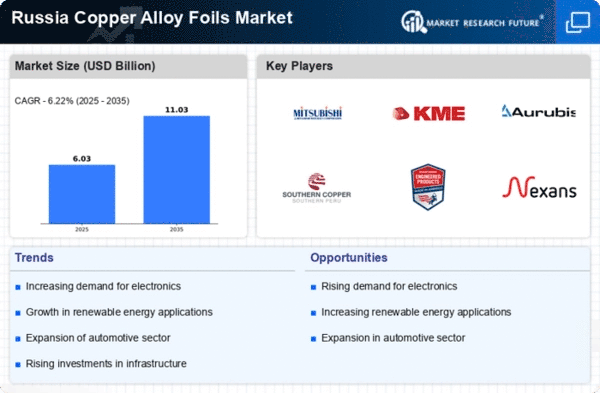

Russia Copper Alloy Foils Market Summary

As per Market Research Future analysis, the Copper Alloy Foils Market Size was estimated at 5.68 USD Billion in 2024. The Copper Alloy-foils market is projected to grow from 6.03 USD Billion in 2025 to 11.03 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 6.2% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Russia The Russia copper alloy-foils market is poised for growth. This growth is driven by technological advancements and rising demand in key sectors.

- Technological advancements are enhancing the production efficiency of copper alloy foils.

- Sustainability initiatives are increasingly influencing manufacturing practices within the market.

- The electronics segment remains the largest, while the automotive segment is the fastest-growing in terms of demand.

- Rising demand in electronics and infrastructure development projects are key drivers of market growth.

Market Size & Forecast

| 2024 Market Size | 5.68 (USD Billion) |

| 2035 Market Size | 11.03 (USD Billion) |

| CAGR (2025 - 2035) | 6.22% |

Major Players

Mitsubishi Materials Corporation (JP), KME Germany GmbH (DE), Aurubis AG (DE), Southern Copper Corporation (US), Chase Brass and Copper Company, LLC (US), Nexans S.A. (FR), KGHM Polska Miedź S.A. (PL), Mueller Industries, Inc. (US)