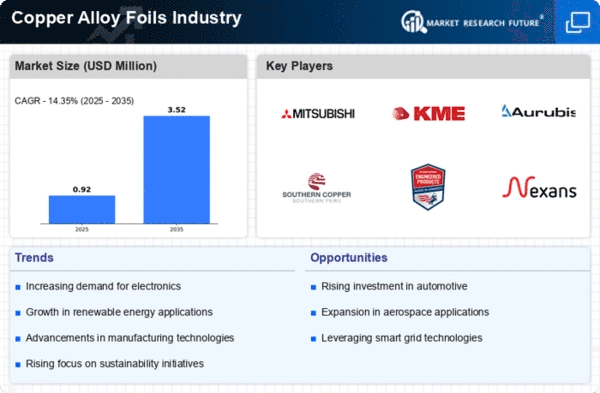

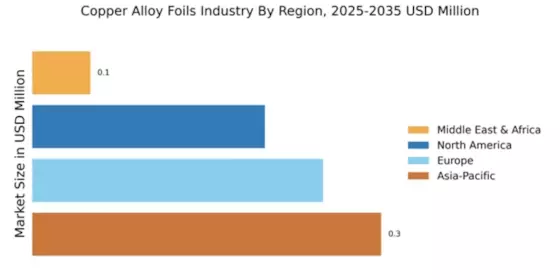

North America : Established Market with Growth Potential

The North American copper alloy foils market is projected to grow steadily, driven by increasing demand in electronics and automotive sectors. With a market share of 20% in 2025, the region benefits from robust manufacturing capabilities and technological advancements. Regulatory support for sustainable practices is also a key driver, encouraging innovation and efficiency in production processes.

Leading countries like the US and Canada are home to major players such as Southern Copper Corporation and Chase Brass & Copper Company, LLC. The competitive landscape is characterized by a mix of established firms and emerging companies, all vying for market share. The presence of advanced manufacturing facilities and a skilled workforce further enhances the region's attractiveness for investment in copper alloy foils.

Europe : Innovation and Sustainability Focus

Europe's copper alloy foils market is characterized by a strong emphasis on innovation and sustainability, holding a market share of 25% in 2025. The region's growth is fueled by stringent environmental regulations and a shift towards electric vehicles, which require high-quality copper components. Additionally, government initiatives promoting green technologies are catalyzing demand for copper alloys.

Germany, France, and Poland are leading countries in this sector, with key players like KME Germany GmbH and Aurubis AG driving advancements. The competitive landscape is marked by collaborations and partnerships aimed at enhancing product offerings. The presence of a well-established supply chain and R&D facilities further solidifies Europe's position in the global market.

Asia-Pacific : Emerging Powerhouse in Copper Alloys

Asia-Pacific is the largest market for copper alloy foils, commanding a significant share of 30% in 2025. The region's growth is driven by rapid industrialization, urbanization, and increasing demand from the electronics and automotive sectors. Countries like China and Japan are at the forefront, supported by favorable government policies and investments in infrastructure. The region's regulatory environment is also evolving to promote sustainable practices in manufacturing.

China, with its vast manufacturing capabilities, is home to major players like Jiangxi Copper Corporation Limited. The competitive landscape is intense, with numerous local and international firms competing for market share. The presence of advanced technology and a skilled workforce further enhances the region's attractiveness for copper alloy production.

Middle East and Africa : Emerging Market with Growth Opportunities

The Middle East and Africa region represents an emerging market for copper alloy foils, with a market share of 5% in 2025. Growth is driven by increasing investments in infrastructure and construction, alongside a rising demand for electrical components. Regulatory frameworks are gradually improving, encouraging foreign investment and technology transfer in the manufacturing sector.

Countries like South Africa and the UAE are leading the way, with a growing number of local manufacturers entering the market. The competitive landscape is still developing, with opportunities for both established players and new entrants. The region's rich mineral resources and strategic location further enhance its potential in the copper alloy foils industry.