The ammonia market exhibits a competitive landscape characterized by a blend of established players and emerging entities, driven by factors such as increasing agricultural demand and the push for sustainable practices. Key players like Yara International ASA (NO), CF Industries Holdings Inc (US), and BASF SE (DE) are strategically positioned to leverage their extensive operational capabilities and innovative approaches. Yara International ASA (NO) focuses on enhancing its product portfolio through technological advancements, while CF Industries Holdings Inc (US) emphasizes operational efficiency and cost leadership. BASF SE (DE) is actively pursuing sustainability initiatives, which collectively shape a competitive environment that prioritizes innovation and environmental responsibility.The ammonia market's structure appears moderately fragmented, with several key players exerting influence over pricing and supply dynamics. Companies are increasingly localizing manufacturing to reduce transportation costs and enhance supply chain resilience. This tactic not only optimizes operational efficiency but also aligns with regional demand fluctuations, allowing firms to respond swiftly to market changes. The collective influence of these major players fosters a competitive atmosphere where strategic collaborations and partnerships are becoming increasingly vital.

In October Yara International ASA (NO) announced a partnership with a leading technology firm to develop a new digital platform aimed at optimizing fertilizer application in agriculture. This strategic move is significant as it underscores Yara's commitment to integrating digital solutions into its operations, potentially enhancing customer engagement and operational efficiency. The collaboration may also position Yara as a frontrunner in the digital transformation of the agricultural sector.

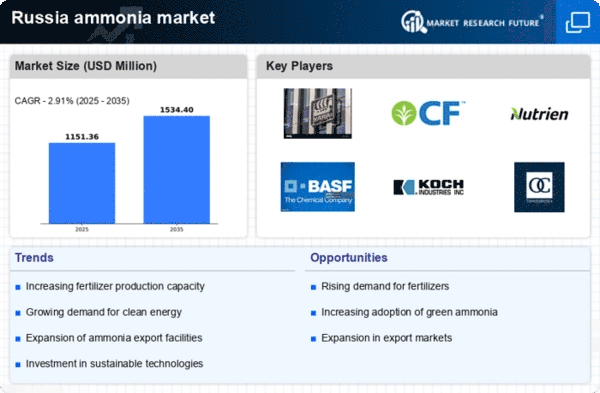

In September CF Industries Holdings Inc (US) unveiled plans to expand its production capacity in Russia by 15%, a move that reflects its confidence in the growing demand for ammonia in the region. This expansion is likely to bolster CF Industries' market share and reinforce its position as a key supplier, particularly in light of increasing agricultural needs. The investment indicates a long-term commitment to the Russian market, aligning with broader trends of regional growth.

In August BASF SE (DE) launched a new line of ammonia products designed to meet stringent environmental regulations. This initiative not only demonstrates BASF's proactive approach to sustainability but also positions the company favorably in a market that is increasingly prioritizing eco-friendly solutions. The introduction of these products may enhance BASF's competitive edge, appealing to environmentally conscious consumers and businesses alike.

As of November the ammonia market is witnessing trends that emphasize digitalization, sustainability, and the integration of advanced technologies such as AI. Strategic alliances are shaping the competitive landscape, enabling companies to pool resources and expertise to address evolving market demands. The shift from price-based competition to a focus on innovation and supply chain reliability is becoming evident, suggesting that future competitive differentiation will hinge on the ability to adapt to these trends and deliver value through technological advancements.