North America : Market Leader in Services

North America is poised to maintain its leadership in the Rolling Stock Maintenance and Repair Services Market, holding a market size of $12.0 billion. Key growth drivers include increasing investments in rail infrastructure, a focus on sustainability, and stringent safety regulations. The demand for efficient and reliable rail services is further propelled by urbanization and the need for enhanced public transport systems. Regulatory support for modernization initiatives is also a significant catalyst for growth.

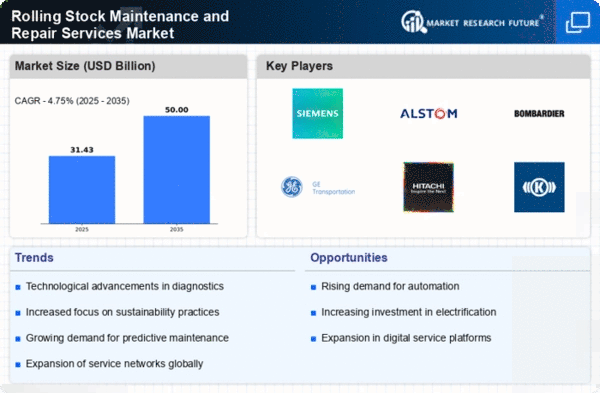

The competitive landscape in North America is characterized by the presence of major players such as GE Transportation and Bombardier, alongside international firms like Siemens and Alstom. The U.S. and Canada are the leading countries, with substantial investments in rail technology and maintenance services. The market is expected to grow as these companies innovate and expand their service offerings, ensuring high standards of safety and efficiency.

Europe : Innovation and Sustainability Focus

Europe's Rolling Stock Maintenance and Repair Services Market is projected to reach $10.0 billion, driven by a strong emphasis on sustainability and innovation. The European Union's commitment to reducing carbon emissions and enhancing public transport systems has led to increased investments in rail infrastructure. Regulatory frameworks, such as the European Green Deal, are pivotal in shaping market dynamics, promoting cleaner and more efficient rail services.

Leading countries in this region include Germany, France, and the UK, where companies like Alstom and Siemens are at the forefront of technological advancements. The competitive landscape is robust, with a mix of established players and emerging firms focusing on eco-friendly solutions. The market is characterized by collaborations and partnerships aimed at enhancing service efficiency and sustainability, ensuring a resilient rail network for the future.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region is witnessing rapid growth in the Rolling Stock Maintenance and Repair Services Market, with a market size of $6.0 billion. Key drivers include urbanization, increasing population density, and government initiatives to enhance public transport systems. Countries like China and India are investing heavily in rail infrastructure, leading to a surge in demand for maintenance and repair services. Regulatory support for modernization and safety standards is also a significant factor in this growth trajectory.

China is the dominant player in this market, with substantial investments in high-speed rail and urban transit systems. Other notable countries include Japan and India, where companies like Hitachi Rail and Bombardier are expanding their presence. The competitive landscape is evolving, with a focus on technological advancements and partnerships to improve service delivery and efficiency, catering to the growing demand for reliable rail services.

Middle East and Africa : Developing Rail Infrastructure

The Middle East and Africa region is emerging as a significant player in the Rolling Stock Maintenance and Repair Services Market, with a market size of $2.0 billion. The growth is driven by increasing investments in rail infrastructure, particularly in countries like the UAE and South Africa. Government initiatives aimed at enhancing public transport systems and improving connectivity are pivotal in shaping market dynamics. Regulatory frameworks are gradually evolving to support these developments, fostering a conducive environment for growth.

In the UAE, substantial investments in rail projects are underway, while South Africa is focusing on modernizing its rail network. The competitive landscape includes both local and international players, with companies like Stadler Rail and CAF making strides in the region. As the demand for efficient rail services grows, the market is expected to expand, presenting opportunities for innovation and investment in maintenance and repair services.