Rising Data Security Threats

The surge in data security threats is a crucial driver for the Global IT Asset Disposition Market ITAD Market Industry. Cybersecurity incidents are becoming more prevalent, prompting organizations to prioritize secure data destruction during asset disposal. High-profile data breaches have underscored the importance of safeguarding sensitive information, leading to increased investments in ITAD services. Companies are seeking certified ITAD providers to ensure compliance with data protection regulations and mitigate risks associated with data leaks. This heightened focus on data security is likely to bolster the market, as organizations recognize the necessity of secure IT asset disposal.

Growing Environmental Concerns

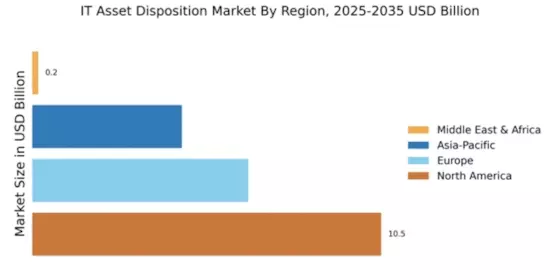

Environmental sustainability is a pivotal driver in the Global IT Asset Disposition Market ITAD Market Industry. With increasing awareness of electronic waste and its detrimental effects on the environment, organizations are compelled to adopt responsible disposal practices. Governments are promoting recycling initiatives and encouraging businesses to minimize their carbon footprint. For example, the U.S. Environmental Protection Agency (EPA) emphasizes the importance of e-waste recycling. This growing environmental consciousness is likely to propel the market, as companies seek ITAD solutions that align with sustainability goals. The Global IT Asset Disposition Market ITAD Market Industry is expected to grow significantly, potentially reaching 50.7 USD Billion by 2035.

Increasing Regulatory Compliance

The Global IT Asset Disposition Market ITAD Market Industry is experiencing heightened demand due to increasing regulatory compliance requirements. Governments worldwide are implementing stringent regulations regarding data protection and environmental sustainability. For instance, the General Data Protection Regulation (GDPR) in Europe mandates strict data handling practices, compelling organizations to ensure secure disposal of IT assets. This regulatory landscape drives companies to seek reliable ITAD services, thereby expanding the market. As organizations prioritize compliance, the Global IT Asset Disposition Market ITAD Market Industry is projected to reach 21.3 USD Billion in 2024, reflecting the urgency for secure and compliant asset disposal.

Rapid Technological Advancements

Technological advancements are reshaping the Global IT Asset Disposition Market ITAD Market Industry. The rapid pace of innovation leads to frequent upgrades of IT equipment, resulting in a growing volume of obsolete assets. Organizations are increasingly aware of the need to dispose of outdated technology securely and responsibly. As new technologies emerge, such as cloud computing and artificial intelligence, the demand for efficient ITAD solutions intensifies. This trend indicates a robust growth trajectory for the market, with a projected compound annual growth rate of 8.2% from 2025 to 2035. Consequently, businesses are investing in ITAD services to manage their asset lifecycle effectively.

Increased Adoption of Circular Economy Practices

The Global IT Asset Disposition Market ITAD Market Industry is witnessing a shift towards circular economy practices. Organizations are increasingly adopting strategies that emphasize the reuse and recycling of IT assets to minimize waste and maximize resource efficiency. This trend aligns with global sustainability goals and is supported by government initiatives promoting circular economy principles. As businesses strive to reduce their environmental impact, the demand for ITAD services that facilitate asset recovery and responsible recycling is likely to grow. This shift not only enhances corporate social responsibility but also contributes to the overall expansion of the Global IT Asset Disposition Market ITAD Market Industry.