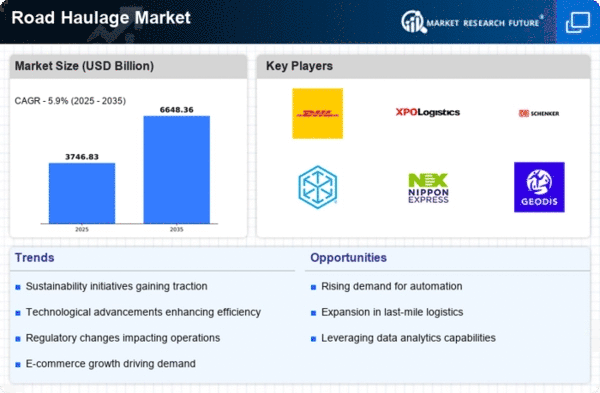

Market Growth Projections

The Global Road Haulage Market Industry is poised for substantial growth, with projections indicating a market value of 6276.5 USD Billion by 2035. This growth trajectory is supported by various factors, including increasing demand for logistics services, infrastructure improvements, and technological advancements. The compound annual growth rate of 5.53% from 2025 to 2035 suggests a robust expansion phase for the industry. As businesses continue to adapt to changing market dynamics, the road haulage sector is likely to evolve, presenting new opportunities for stakeholders. The overall outlook remains optimistic, with a focus on innovation and sustainability driving future developments.

Growing Demand for E-commerce

The surge in e-commerce activities globally is a primary driver of the Global Road Haulage Market Industry. As online shopping continues to expand, the need for efficient logistics and transportation solutions becomes increasingly critical. In 2024, the market is valued at approximately 3472.5 USD Billion, reflecting the heightened demand for road haulage services to facilitate timely deliveries. Companies are investing in advanced logistics technologies to enhance their supply chain efficiency, which further propels the growth of the road haulage sector. This trend is expected to continue, as e-commerce sales are projected to rise significantly, necessitating robust road transport networks.

Infrastructure Development Initiatives

Infrastructure development plays a pivotal role in shaping the Global Road Haulage Market Industry. Governments worldwide are investing heavily in road construction and maintenance to improve connectivity and reduce transportation costs. Enhanced road networks facilitate smoother and faster movement of goods, thereby increasing the efficiency of haulage operations. For instance, initiatives in developing regions aim to upgrade existing roads and build new highways, which could potentially lead to a more streamlined logistics framework. As infrastructure improves, the market is likely to see a corresponding increase in demand, with projections indicating a market value of 6276.5 USD Billion by 2035.

Rising Fuel Prices and Cost Management

Rising fuel prices are a critical factor impacting the Global Road Haulage Market Industry. Fluctuations in fuel costs can significantly affect operational expenses for logistics providers. As fuel prices rise, companies are compelled to adopt cost management strategies to maintain profitability. This may include optimizing routes, investing in fuel-efficient vehicles, and implementing better fleet management practices. The need for effective cost control measures is likely to drive innovation within the industry, as companies seek to mitigate the impact of fuel price volatility. Consequently, the market may witness a shift towards more sustainable and cost-effective transport solutions.

Technological Advancements in Logistics

Technological advancements are transforming the Global Road Haulage Market Industry by enhancing operational efficiency and reducing costs. Innovations such as GPS tracking, route optimization software, and automated inventory management systems are becoming commonplace. These technologies enable companies to monitor shipments in real-time, optimize delivery routes, and manage resources more effectively. As a result, logistics providers can respond swiftly to market demands, thereby improving customer satisfaction. The integration of technology is expected to drive the market's growth, with a projected compound annual growth rate of 5.53% from 2025 to 2035, indicating a robust future for road haulage.

Environmental Regulations and Sustainability Initiatives

The increasing emphasis on environmental sustainability is influencing the Global Road Haulage Market Industry significantly. Governments are implementing stricter regulations aimed at reducing carbon emissions from transportation. This has led to a shift towards greener logistics solutions, including the adoption of electric and hybrid vehicles in road haulage. Companies are also exploring alternative fuels and optimizing their fleets to comply with environmental standards. As sustainability becomes a priority, the market is likely to evolve, with businesses seeking to align their operations with eco-friendly practices. This shift may create new opportunities and challenges within the road haulage sector.