Market Growth Projections

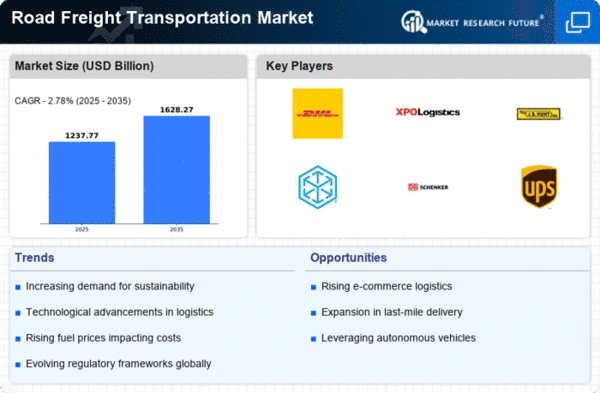

The Global Road Freight Transportation Market Industry is poised for substantial growth, with projections indicating a market size of 1185.1 USD Billion in 2024 and an anticipated increase to 1628.6 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 2.93% from 2025 to 2035. Various factors contribute to this optimistic outlook, including the expansion of e-commerce, infrastructure development, and technological advancements. As the market evolves, stakeholders are likely to adapt to changing consumer preferences and regulatory landscapes, positioning themselves strategically to capitalize on emerging opportunities in the road freight sector.

Growing Demand for E-commerce

The surge in e-commerce activities is a pivotal driver for the Global Road Freight Transportation Market Industry. As online shopping continues to gain traction, the need for efficient and timely delivery of goods has escalated. In 2024, the market is projected to reach 1185.1 USD Billion, reflecting the increasing reliance on road freight to meet consumer expectations for rapid delivery. This trend is likely to persist, with the market anticipated to grow to 1628.6 USD Billion by 2035, indicating a robust compound annual growth rate of 2.93% from 2025 to 2035. The integration of advanced logistics solutions further enhances the efficiency of road freight services, catering to the evolving demands of e-commerce.

Infrastructure Development Initiatives

Investment in transportation infrastructure is crucial for the advancement of the Global Road Freight Transportation Market Industry. Governments worldwide are prioritizing the enhancement of road networks, bridges, and logistics hubs to facilitate smoother freight movement. Such initiatives not only improve connectivity but also reduce transit times, thereby boosting the efficiency of road freight operations. For instance, various countries are allocating substantial budgets for infrastructure projects, which are expected to yield positive impacts on freight transportation. Improved infrastructure is likely to attract more businesses to utilize road freight services, further stimulating market growth and contributing to the projected increase in market size.

Rising Fuel Prices and Cost Management

Fluctuating fuel prices pose a significant challenge to the Global Road Freight Transportation Market Industry. As fuel costs continue to rise, logistics companies are compelled to implement effective cost management strategies to maintain profitability. This situation drives the need for more fuel-efficient vehicles and optimized routing to reduce fuel consumption. Companies are increasingly investing in technologies that enhance fuel efficiency and lower operational costs. Additionally, the pressure to manage expenses effectively may lead to consolidation within the industry, as smaller players seek partnerships or mergers to enhance their competitive positioning. This dynamic could reshape the market landscape, influencing future growth trajectories.

Technological Advancements in Logistics

Technological innovations are transforming the Global Road Freight Transportation Market Industry by enhancing operational efficiency and reducing costs. The adoption of advanced tracking systems, automated logistics management, and data analytics is becoming increasingly prevalent. These technologies enable real-time monitoring of shipments, optimizing routes and minimizing delays. As a result, companies can improve their service offerings and customer satisfaction. The integration of artificial intelligence and machine learning in logistics operations is also anticipated to drive growth in the market. This technological evolution aligns with the projected market expansion, as businesses seek to leverage these advancements to remain competitive in a rapidly changing environment.

Sustainability and Environmental Regulations

The emphasis on sustainability is reshaping the Global Road Freight Transportation Market Industry. Governments and regulatory bodies are implementing stringent environmental regulations aimed at reducing carbon emissions from freight transportation. This shift is prompting logistics companies to adopt greener practices, such as utilizing electric vehicles and optimizing delivery routes to minimize fuel consumption. The growing awareness of environmental issues among consumers is also influencing their preferences, leading to a demand for sustainable logistics solutions. Consequently, companies that prioritize sustainability are likely to gain a competitive edge in the market, aligning with the broader trend of increasing environmental consciousness in the transportation sector.