Market Growth Projections

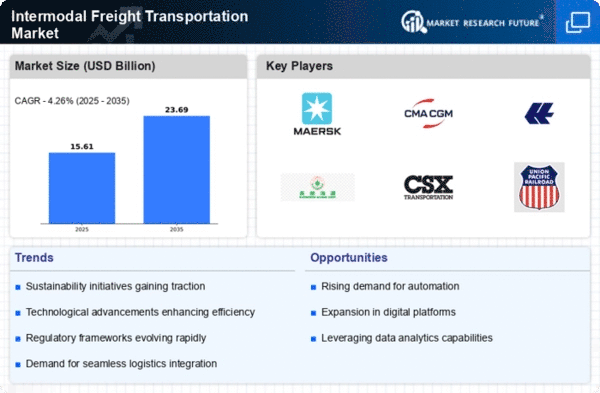

The Global Intermodal Freight Transportation Market Industry is projected to experience substantial growth, with estimates indicating a market value of 15.0 USD Billion in 2024 and a potential increase to 23.7 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 4.27% from 2025 to 2035. Such projections highlight the increasing reliance on intermodal transportation solutions as businesses seek to enhance efficiency and reduce costs. The market's expansion is likely influenced by various factors, including technological advancements, government initiatives, and evolving consumer preferences.

Expansion of E-commerce and Retail Sectors

The rapid expansion of the e-commerce and retail sectors significantly influences the Global Intermodal Freight Transportation Market Industry. As online shopping continues to gain traction, the demand for reliable and swift delivery services escalates. Intermodal freight transportation provides a flexible solution to meet these demands, facilitating the movement of goods across various regions. The market is projected to grow to 23.7 USD Billion by 2035, indicating a robust growth trajectory. This growth is further supported by advancements in technology that streamline logistics operations, ensuring that e-commerce businesses can efficiently manage their supply chains.

Growing Demand for Efficient Logistics Solutions

The Global Intermodal Freight Transportation Market Industry experiences a surge in demand for efficient logistics solutions driven by the need for cost-effective and timely delivery of goods. As companies increasingly seek to optimize their supply chains, intermodal transportation offers a viable alternative by combining multiple modes of transport. This trend is reflected in the projected market value, which is expected to reach 15.0 USD Billion in 2024. The integration of rail, road, and maritime transport not only enhances operational efficiency but also reduces carbon emissions, aligning with global sustainability goals.

Technological Advancements in Freight Management

Technological advancements are reshaping the Global Intermodal Freight Transportation Market Industry by enhancing freight management systems. Innovations such as real-time tracking, automated scheduling, and data analytics enable logistics providers to optimize their operations. These technologies improve visibility and efficiency, allowing for better decision-making in the transportation process. As a result, shippers can respond more effectively to market demands and fluctuations. The integration of technology is likely to drive further growth in the intermodal sector, aligning with the increasing complexity of global supply chains.

Government Initiatives and Infrastructure Development

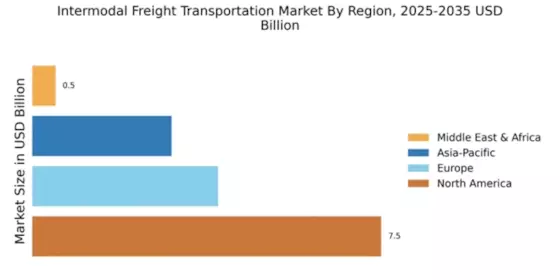

Government initiatives aimed at enhancing transportation infrastructure play a crucial role in the Global Intermodal Freight Transportation Market Industry. Investments in rail networks, ports, and highways are essential for facilitating seamless intermodal connections. For instance, various countries are implementing policies to promote the use of rail transport, which is often more environmentally friendly than road transport. These initiatives not only improve the efficiency of freight movement but also contribute to the projected CAGR of 4.27% from 2025 to 2035. Enhanced infrastructure supports the growth of intermodal transportation, making it a more attractive option for shippers.

Environmental Sustainability and Regulatory Compliance

The growing emphasis on environmental sustainability and regulatory compliance significantly impacts the Global Intermodal Freight Transportation Market Industry. Companies are increasingly adopting intermodal transportation as a means to reduce their carbon footprint and comply with stringent environmental regulations. By leveraging rail and maritime transport, which are generally more sustainable than road transport, businesses can achieve their sustainability goals. This shift not only enhances corporate responsibility but also aligns with consumer preferences for environmentally friendly practices. As sustainability becomes a priority, the intermodal sector is poised for growth, reflecting changing market dynamics.