North America : Market Leader in Risk Services

North America continues to lead the Risk Management and Advisory Services Market, holding a significant market share of 17.5 in 2024. The region's growth is driven by increasing regulatory requirements, technological advancements, and a heightened focus on risk mitigation strategies. Companies are investing in innovative solutions to address emerging risks, particularly in cybersecurity and compliance, which are critical in today's volatile environment.

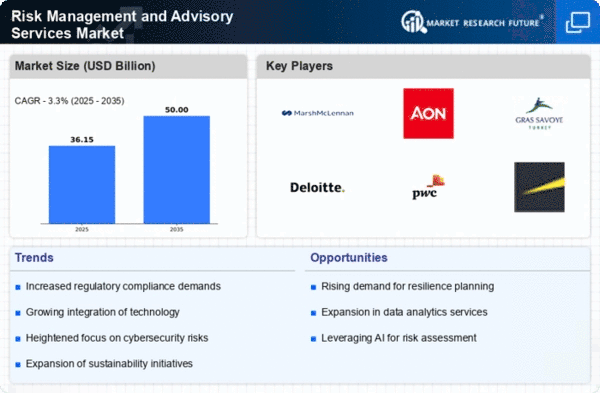

The competitive landscape is robust, with key players such as Marsh McLennan, Aon, and Deloitte dominating the market. The presence of these firms, along with a strong network of local consultancies, enhances service delivery and client engagement. The U.S. remains the largest market, supported by a diverse economy and a strong demand for comprehensive risk management solutions.

Europe : Growing Demand for Advisory Services

Europe's Risk Management and Advisory Services Market is projected to grow, with a market size of 10.5 in 2024. The region is experiencing increased demand for advisory services due to evolving regulatory frameworks and the need for businesses to navigate complex compliance landscapes. Factors such as Brexit and GDPR have heightened the focus on risk management, driving organizations to seek expert guidance.

Leading countries like the UK, Germany, and France are at the forefront of this growth, with major players such as Aon and PwC establishing a strong foothold. The competitive environment is characterized by a mix of global firms and local specialists, ensuring a comprehensive range of services. As organizations prioritize risk management, the market is expected to expand significantly.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region is witnessing a burgeoning Risk Management and Advisory Services Market, with a size of 5.5 in 2024. Rapid economic growth, urbanization, and increasing awareness of risk management are key drivers of this expansion. Governments are also implementing stricter regulations, prompting businesses to invest in advisory services to ensure compliance and mitigate risks effectively.

Countries like China, India, and Japan are leading the charge, with a growing number of local and international firms entering the market. The competitive landscape is evolving, with players like Deloitte and KPMG expanding their presence. As organizations recognize the importance of risk management, the demand for advisory services is set to rise significantly in this region.

Middle East and Africa : Developing Risk Management Sector

The Middle East and Africa (MEA) region is gradually developing its Risk Management and Advisory Services Market, currently valued at 1.5 in 2024. The growth is driven by increasing investments in infrastructure, a focus on regulatory compliance, and the need for businesses to manage risks associated with political and economic instability. Governments are encouraging private sector participation, which is further propelling demand for advisory services.

Countries like South Africa and the UAE are leading the market, with a mix of local and international firms providing services. The competitive landscape is characterized by a growing number of consultancies, including global players like EY and KPMG. As the region continues to evolve, the demand for risk management solutions is expected to increase, reflecting a broader trend towards professional advisory services.