Expansion of E-commerce Platforms

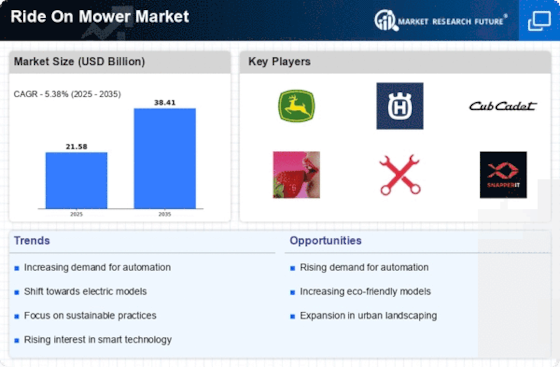

The Ride On Mower Market is experiencing a transformation due to the expansion of e-commerce platforms. As consumers increasingly turn to online shopping for convenience, the availability of ride-on mowers through digital channels is on the rise. This shift not only broadens the market reach for manufacturers but also provides consumers with a wider selection of products. Data indicates that online sales of ride-on mowers have increased by 20% in the past year, reflecting changing consumer purchasing behaviors. The growth of e-commerce is likely to continue influencing the Ride On Mower Market, as more consumers seek the ease of purchasing lawn care equipment from the comfort of their homes.

Technological Advancements in Mower Design

Technological innovation plays a pivotal role in the evolution of the Ride On Mower Market. Manufacturers are increasingly integrating advanced features such as GPS navigation, automated mowing systems, and smartphone connectivity into their products. These enhancements not only improve efficiency but also provide users with greater control and convenience. For instance, the introduction of autonomous mowers has the potential to revolutionize lawn care, allowing users to program mowing schedules remotely. Market data indicates that the adoption of smart technology in ride-on mowers is expected to increase by 15% in the coming years, reflecting a growing consumer appetite for high-tech solutions in lawn maintenance.

Growth of the Commercial Landscaping Sector

The commercial landscaping sector is a significant driver of the Ride On Mower Market. As businesses and institutions prioritize the maintenance of their outdoor spaces, the demand for efficient mowing solutions has surged. This sector encompasses a wide range of applications, from parks and golf courses to corporate campuses. Market data reveals that commercial users are increasingly opting for ride-on mowers due to their ability to cover large areas quickly and effectively. The commercial segment is projected to grow at a rate of 8% annually, highlighting the importance of ride-on mowers in maintaining professional landscapes and enhancing the aesthetic appeal of commercial properties.

Increasing Demand for Sustainable Solutions

The Ride On Mower Market is witnessing a notable shift towards sustainable landscaping solutions. As environmental concerns gain traction, consumers are increasingly seeking mowers that minimize carbon footprints. This trend is reflected in the rising popularity of electric and battery-operated models, which are perceived as eco-friendly alternatives to traditional gas-powered mowers. According to recent data, the market for electric ride-on mowers is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This demand for sustainability is not only driven by consumer preferences but also by regulatory pressures aimed at reducing emissions, thereby shaping the future landscape of the Ride On Mower Market.

Rising Popularity of Residential Landscaping

The Ride On Mower Market is significantly influenced by the increasing interest in residential landscaping. As homeowners invest more in outdoor aesthetics, the demand for efficient and effective lawn care solutions rises. This trend is particularly evident in suburban areas, where larger lawns necessitate the use of ride-on mowers for optimal maintenance. Market analysis suggests that the residential segment accounts for over 60% of total ride-on mower sales, indicating a robust consumer base. Furthermore, the trend towards outdoor living spaces has led to an uptick in landscaping projects, further propelling the demand for ride-on mowers as essential tools for homeowners.