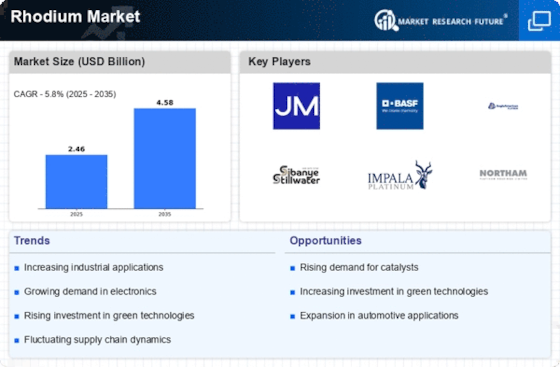

Supply Constraints and Market Volatility

The Rhodium Market faces challenges due to supply constraints, which contribute to market volatility. Rhodium Market is primarily sourced from platinum group metal mines, predominantly located in South Africa and Russia. Geopolitical tensions and mining disruptions can significantly impact supply levels, leading to price fluctuations. In 2025, the price of rhodium has seen considerable volatility, with spikes attributed to supply shortages. This uncertainty may drive manufacturers to secure long-term contracts, further influencing market dynamics. As a result, the Rhodium Market is characterized by a delicate balance between supply and demand, where any disruption can lead to substantial price increases, affecting various sectors reliant on this precious metal.

Increasing Demand in Automotive Catalysts

The Rhodium Market is experiencing a notable surge in demand due to its critical role in automotive catalysts. As stricter emission regulations are enforced, manufacturers are increasingly incorporating rhodium into catalytic converters to reduce harmful emissions. In 2025, the automotive sector accounts for approximately 80% of rhodium consumption, highlighting its importance in achieving compliance with environmental standards. This trend is likely to continue as more countries adopt stringent regulations aimed at reducing air pollution. Furthermore, the shift towards electric vehicles may not diminish the need for rhodium, as hybrid models still require catalytic converters. Thus, the automotive industry's reliance on rhodium is a significant driver for the Rhodium Market, suggesting a robust growth trajectory in the coming years.

Investment in Renewable Energy Technologies

The Rhodium Market is poised for growth as investments in renewable energy technologies increase. Rhodium Market is utilized in various applications, including hydrogen production and fuel cells, which are essential for the transition to cleaner energy sources. In recent years, there has been a marked increase in funding for green technologies, with investments reaching billions of dollars. This trend indicates a growing recognition of the need for sustainable energy solutions. As countries strive to meet their climate goals, the demand for rhodium in renewable energy applications is expected to rise. This shift not only supports the Rhodium Market but also aligns with global efforts to reduce carbon emissions and promote sustainability.

Growing Applications in Electronics and Jewelry

The Rhodium Market is expanding due to its growing applications in electronics and jewelry. Rhodium Market is increasingly used in the electronics sector for its excellent conductivity and resistance to corrosion, making it ideal for connectors and circuit boards. Additionally, the jewelry industry utilizes rhodium plating to enhance the appearance and durability of precious metals. In 2025, the demand for rhodium in these sectors is projected to rise, driven by consumer preferences for high-quality and long-lasting products. This diversification of applications not only bolsters the Rhodium Market but also mitigates risks associated with reliance on a single sector, thereby fostering a more resilient market.

Technological Innovations in Extraction Processes

The Rhodium Market is benefiting from technological innovations in extraction processes, which enhance the efficiency of rhodium recovery. Advances in hydrometallurgy and pyrometallurgy have improved the yield of rhodium from ore, making it more economically viable to extract. These innovations are particularly relevant as the demand for rhodium continues to rise, necessitating more efficient production methods. In 2025, the introduction of new extraction technologies is expected to lower production costs and increase the availability of rhodium in the market. This development not only supports the Rhodium Market but also encourages sustainable practices by reducing waste and environmental impact associated with mining operations.