Market Share

Rhodium Market Share Analysis

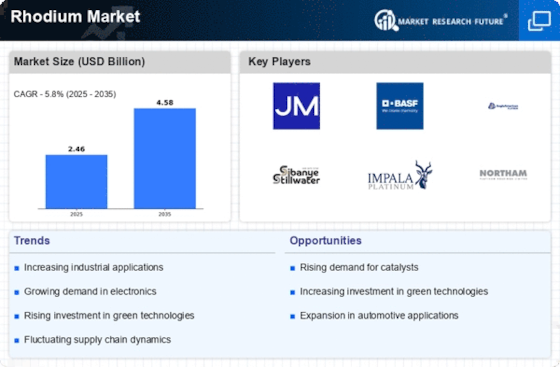

The Rhodium Market is experiencing strategic shifts as companies endeavor to establish dominance in the precious metals sector. To gain a competitive advantage, businesses are implementing various market positioning strategies that include supply chain management, sustainability initiatives, and technological innovation. Here are key strategies employed in the market share positioning of the Rhodium Market: Strategic Supply Chain Management: Leading companies in the Rhodium Market focus on strategic supply chain management to ensure a stable and reliable source of rhodium. This involves establishing partnerships with mining companies, optimizing extraction processes, and maintaining an efficient distribution network. A well-managed supply chain contributes to market stability, enhances reliability, and positions companies as trustworthy suppliers in the competitive rhodium market. Diversification of End-Use Industries: To mitigate risks and expand market reach, companies diversify the applications of rhodium across various end-use industries. This includes its use in automotive catalytic converters, electronics, and jewelry. Diversification allows companies to adapt to changing market demands and regulatory environments, positioning them as versatile players in the rhodium sector. Emphasis on Sustainability in Mining Practices: With an increasing focus on sustainable practices, rhodium mining companies are adopting eco-friendly and ethical mining practices. This includes minimizing environmental impact, ensuring responsible labor practices, and promoting community engagement. Positioning rhodium as a responsibly sourced metal aligns with global sustainability goals and appeals to environmentally conscious consumers and industries. Investment in Research and Development: A commitment to research and development is crucial for staying competitive in the Rhodium Market. Companies invest in R&D to explore new extraction methods, improve refining processes, and discover innovative applications for rhodium. Innovations stemming from R&D efforts contribute to positioning manufacturers as leaders in the development of cutting-edge uses for rhodium, fostering long-term market share growth. Global Market Expansion: Companies aiming for increased market share strategically expand their global presence. This involves entering new markets, establishing partnerships with distributors, and adapting rhodium products to meet diverse international standards. A global footprint not only widens the customer base but also positions a company as a reliable supplier capable of meeting the diverse needs of an international clientele. Optimization of Recycling Processes: Given the finite nature of natural resources, companies in the Rhodium Market focus on optimizing recycling processes. This includes developing efficient methods to extract rhodium from end-of-life products, reducing reliance on primary mining. Positioning rhodium as a recyclable and sustainable metal enhances a company's reputation and appeals to environmentally conscious clients. Transparency and Certification: Transparency in the supply chain and adherence to ethical and responsible practices contribute to market positioning. Companies that provide clear information about the origin and extraction processes of their rhodium build trust with customers. Certification of responsible mining practices and adherence to industry standards further solidify a company's reputation as a responsible player in the rhodium market. Strategic Marketing and Branding: Effective marketing and branding strategies play a crucial role in market share positioning. Companies focus on communicating the rarity, durability, and unique properties of rhodium through various channels. Strategic marketing efforts create awareness and differentiate a company's rhodium products in a competitive market, influencing purchasing decisions and market positioning.

Leave a Comment