Research Methodology on Test Measurement Equipment Market

Introduction

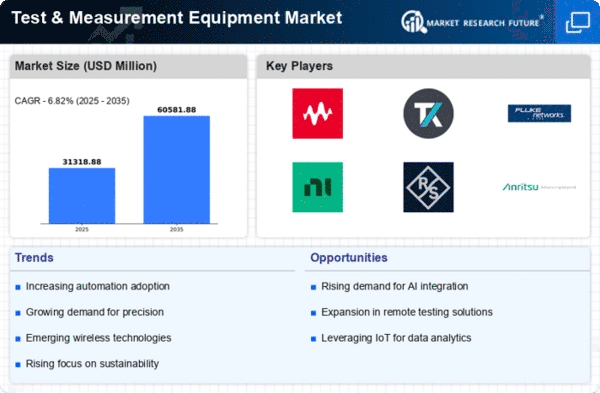

The research study presented here is on the global test and measurement equipment market. Test and measurement equipment are instruments and tools used for measuring, testing, and managing products, materials, and other components for quality control, performance evaluation, and other testing methods.

Various types of test and measurement equipment, such as electronic test equipment, measuring instruments, and others, are widely being used in various end-user industries, including aerospace, automotive, food and beverage, biotechnology, and healthcare, among others.

The study examines the market based on key segments like equipment type, end-user, region and key players. The market size in terms of value and volume is obtained by taking into account the revenue generated by each segment. Year-on-year growth of the market is also estimated to give the reader a deeper understanding of the overall market outlook and growth prospects.

Objectives of the Study

- The primary objective of this study is to understand the global test and measurement equipment market and provide detailed insights into the market dynamics and prospects.

- To analyze the growth parameters of the global test and measurement equipment market in terms of values, volume and year-on-year growth.

- To understand the factors influencing the growth of the global test and measurement equipment market.

- To identify major companies operating in the global test and measurement equipment market.

- To analyze the market size and forecast for each equipment type, end-user and region.

Research Methodology

Research Approach

This study relies on both primary and secondary research methodologies. To gain an in-depth understanding of the market and its dynamics, we conducted a qualitative and quantitative analysis of the data sourced from a range of secondary and primary sources. The secondary sources for the study include journals, reports, technology magazines, published industry articles, market databases, and others.

Data Collection

We relied on both primary and secondary sources to collect the required data. The secondary sources used to compile the data include company websites, annual reports, industry magazines, and other published materials. To get further insights into the market, MRFR interviewed industry experts, including CEOs, VPs, directors, and marketing executives to get an in-depth understanding of the market structure and dynamics.

Analysis Method

To analyze the market data and perform an in-depth analysis, MRFR employed a three-step approach. Firstly, the data is collected from primary and secondary sources. Secondly, MRFR has analyzed the collected data using analytical techniques such as SWOT analysis, Porter’s Five Forces Model, and trend analysis. Finally, MRFR has arrived at the market size, market insights, and market forecast.

Market Segmentation

The global test and measurement equipment market is segmented based on

- Equipment type

- Electronic test equipment

- Measuring instruments

- Others

- End-User

- Aerospace

- Automotive

- Food and beverage

- Biotechnology

- Healthcare

- Others

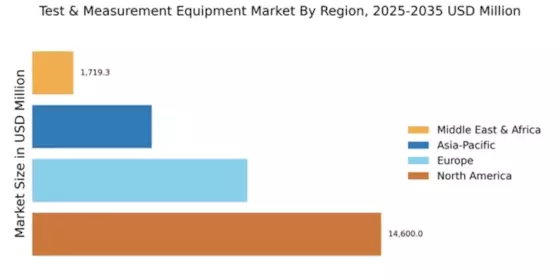

- Region

- North America

- Europe

- Asia-Pacific

- Rest of the world

Conclusion

The global test and measurement equipment market is expected to witness significant growth during the forecast period 2023 to 2030. The growth of the market is attributed to the rising demand for electronic and measuring instruments from the various end-user industries, such as aerospace, automotive, food and beverage, and biotechnology, among others. The research used both primary and secondary research approaches to gain an understanding of the market dynamics, trends, market growth prospects, and technology advancements. MRFR has segmented the market based on equipment type, end-user and region to gain deeper insights into the global test and measurement equipment market.