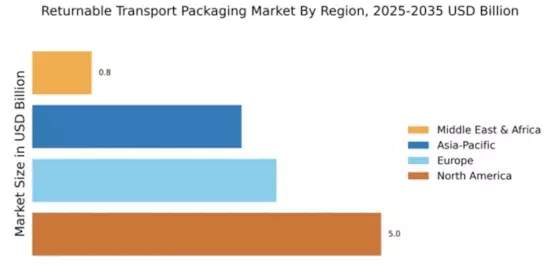

North America : Market Leader in Packaging Solutions

North America is poised to maintain its leadership in the Returnable Transport Packaging Market, holding a significant market share of 5.0 in 2024. The region's growth is driven by increasing demand for sustainable packaging solutions, stringent regulations promoting recycling, and a robust logistics infrastructure. Companies are increasingly adopting returnable packaging to reduce waste and enhance supply chain efficiency, aligning with environmental goals. The competitive landscape in North America is characterized by the presence of key players such as CHEP, Rehrig Pacific Company, and Tosca Services. These companies are leveraging advanced technologies and innovative designs to meet the evolving needs of various industries, including food and beverage, automotive, and retail. The focus on sustainability and cost-effectiveness is expected to further propel market growth in this region.

Europe : Sustainable Packaging Initiatives

Europe is witnessing a significant shift towards sustainable packaging solutions, with a market size of 3.5 in 2024. The region's growth is fueled by stringent environmental regulations and a strong consumer preference for eco-friendly products. Governments are actively promoting the use of returnable transport packaging to minimize waste and enhance recycling efforts, creating a favorable regulatory environment for market expansion. Leading countries such as Germany, France, and the UK are at the forefront of this trend, with major players like IFCO SYSTEMS and Schoeller Allibert driving innovation. The competitive landscape is marked by collaborations and partnerships aimed at developing advanced packaging solutions that meet both regulatory requirements and consumer expectations. This focus on sustainability is expected to continue shaping the market dynamics in Europe.

Asia-Pacific : Emerging Market Potential

Asia-Pacific is emerging as a significant player in the Returnable Transport Packaging Market, with a market size of 3.0 in 2024. The region's growth is driven by rapid industrialization, increasing urbanization, and a growing emphasis on sustainable practices. Countries like China and India are witnessing a surge in demand for returnable packaging solutions as businesses seek to optimize supply chains and reduce environmental impact. The competitive landscape in Asia-Pacific is evolving, with both local and international players vying for market share. Companies such as Kuehne + Nagel and Palletways are expanding their operations to cater to the increasing demand. The focus on innovation and sustainability is expected to drive further growth, making this region a key area of interest for investors and stakeholders in the packaging industry.

Middle East and Africa : Developing Market Landscape

The Middle East and Africa region is gradually developing its Returnable Transport Packaging Market, with a market size of 0.85 in 2024. The growth is primarily driven by increasing investments in infrastructure and logistics, alongside a rising awareness of sustainable packaging solutions. Governments are beginning to implement regulations that encourage the use of returnable packaging, which is expected to boost market growth in the coming years. Countries like South Africa and the UAE are leading the charge, with local and international companies exploring opportunities in this emerging market. The presence of key players is still limited, but as demand grows, more companies are likely to enter the market, enhancing competition and innovation. This region presents unique opportunities for growth, particularly in sectors such as food and beverage and retail.