Cost Efficiency

Cost efficiency remains a pivotal driver in the Global Returnable Packaging Market Industry. Organizations are increasingly recognizing the long-term savings associated with reusable packaging solutions. By investing in returnable packaging, companies can significantly reduce costs related to single-use packaging, waste disposal, and logistics. For example, businesses that switch to returnable containers often report savings of up to 30% in packaging costs. This financial incentive is expected to contribute to a market growth trajectory, with projections indicating a market size of 235.5 USD Billion by 2035. The potential for cost reduction is compelling for companies across various sectors.

Regulatory Compliance

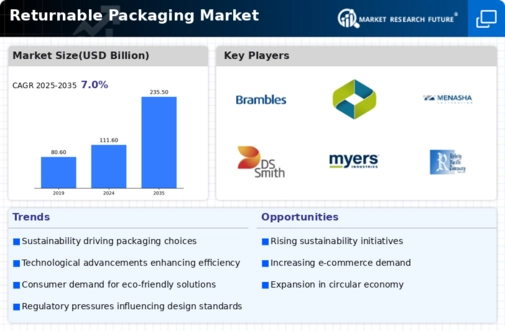

Regulatory compliance is a crucial factor influencing the Global Returnable Packaging Market Industry. Governments worldwide are enacting stringent regulations aimed at reducing plastic waste and promoting sustainable practices. These regulations often encourage or mandate the use of returnable packaging solutions. For instance, the European Union has introduced directives that require businesses to adopt more sustainable packaging methods. Compliance with these regulations not only helps companies avoid penalties but also enhances their reputation among consumers. As a result, the market is likely to experience robust growth, with a projected CAGR of 7.02% from 2025 to 2035, driven by the need for compliance.

Market Growth Projections

The Global Returnable Packaging Market Industry is poised for substantial growth, with projections indicating a market size of 235.5 USD Billion by 2035. This growth trajectory is supported by various factors, including increasing sustainability initiatives, cost efficiency, and regulatory compliance. The anticipated CAGR of 7.02% from 2025 to 2035 reflects the rising adoption of returnable packaging solutions across multiple sectors. As businesses recognize the economic and environmental benefits of reusable packaging, the market is likely to expand significantly. This growth presents opportunities for innovation and investment in sustainable packaging technologies.

Sustainability Initiatives

The Global Returnable Packaging Market Industry is increasingly driven by sustainability initiatives as businesses seek to reduce their environmental footprint. Companies are adopting returnable packaging solutions to minimize waste and promote recycling. For instance, major retailers are implementing reusable containers and pallets, which not only decrease landfill contributions but also enhance brand image. This trend aligns with global efforts to achieve sustainability goals, potentially leading to a market valuation of 111.6 USD Billion in 2024. As consumers become more environmentally conscious, the demand for sustainable packaging options is likely to grow, further propelling the market forward.

Technological Advancements

Technological advancements play a significant role in shaping the Global Returnable Packaging Market Industry. Innovations in materials and design are enhancing the durability and functionality of returnable packaging solutions. For example, the development of lightweight yet robust materials allows for easier handling and transportation, thereby increasing efficiency. Additionally, advancements in tracking technologies enable companies to monitor the lifecycle of returnable packaging, optimizing their supply chain processes. These technological improvements are likely to attract more businesses to adopt returnable solutions, contributing to the market's anticipated growth and aligning with global trends towards efficiency and sustainability.

Consumer Demand for Reusability

Consumer demand for reusability is a driving force in the Global Returnable Packaging Market Industry. As consumers become more aware of environmental issues, they increasingly prefer products packaged in reusable materials. This shift in consumer behavior is prompting companies to reevaluate their packaging strategies and invest in returnable solutions. For instance, brands that offer products in returnable packaging often see enhanced customer loyalty and satisfaction. This trend is expected to bolster the market, with projections indicating a market size of 111.6 USD Billion in 2024. The growing preference for sustainable packaging options is likely to shape future market dynamics.