E-commerce Growth

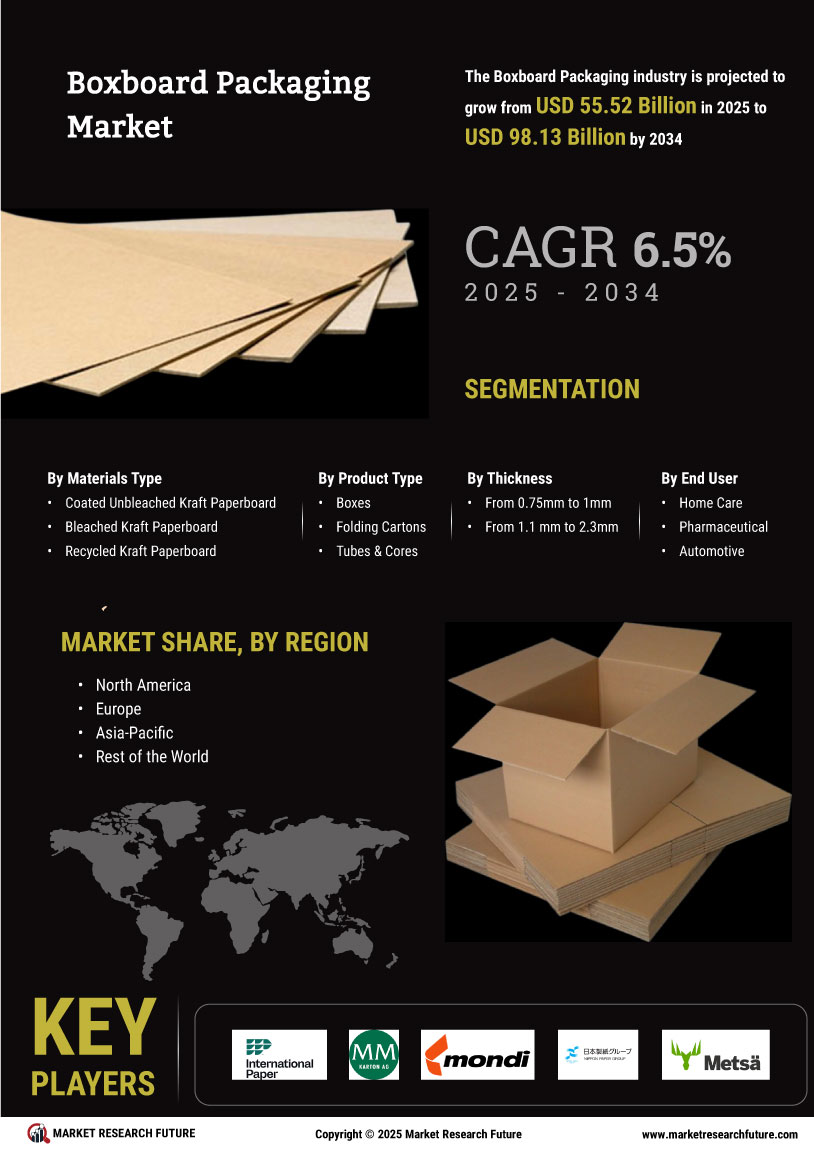

The rapid expansion of the e-commerce sector is a pivotal driver for the Global Boxboard Packaging Market Industry. As online shopping continues to flourish, the demand for efficient and protective packaging solutions rises. Boxboard packaging offers lightweight and durable options that cater to the needs of e-commerce businesses, ensuring products arrive safely at their destinations. This trend is underscored by the fact that e-commerce sales are expected to grow significantly, further propelling the market. The anticipated growth in this sector contributes to the overall market value, which is projected to reach 104.5 USD Billion by 2035.

Regulatory Compliance

Regulatory compliance is a driving force in the Global Boxboard Packaging Market Industry, as governments worldwide implement stricter packaging regulations to promote sustainability and consumer safety. These regulations often mandate the use of recyclable materials and the reduction of harmful substances in packaging. Companies that proactively adapt to these regulations not only avoid penalties but also enhance their brand reputation among environmentally conscious consumers. This compliance trend is likely to stimulate demand for boxboard packaging solutions, contributing to the market's projected growth to 52.1 USD Billion in 2024.

Sustainability Initiatives

The Global Boxboard Packaging Market Industry is increasingly driven by sustainability initiatives as consumers and businesses alike prioritize eco-friendly packaging solutions. With a growing emphasis on reducing plastic waste, boxboard packaging, made from renewable resources, is gaining traction. For instance, many companies are adopting recyclable and biodegradable materials, aligning with global sustainability goals. This shift not only meets consumer demand but also complies with stringent regulations aimed at reducing environmental impact. As a result, the market is projected to reach 52.1 USD Billion in 2024, reflecting a significant trend towards sustainable packaging solutions.

Technological Advancements

Technological advancements are significantly influencing the Global Boxboard Packaging Market Industry by enhancing production efficiency and product quality. Innovations in printing technology, digital design, and automation are enabling manufacturers to produce high-quality boxboard packaging at lower costs. These advancements not only improve the aesthetic appeal of packaging but also optimize material usage, reducing waste. As companies invest in these technologies, they can respond more effectively to market demands and consumer preferences. This trend is expected to contribute to the market's growth trajectory, aligning with the projected increase in market value to 104.5 USD Billion by 2035.

Consumer Preference for Convenience

In the Global Boxboard Packaging Market Industry, consumer preference for convenience plays a crucial role in shaping packaging trends. As lifestyles become increasingly fast-paced, consumers favor packaging that is easy to open, resealable, and portable. Boxboard packaging meets these demands effectively, offering practical solutions for various products, from food to electronics. This shift in consumer behavior encourages manufacturers to innovate and design packaging that enhances user experience. Consequently, the market is likely to witness sustained growth, with a projected compound annual growth rate of 6.53% from 2025 to 2035, reflecting the importance of convenience in packaging.