North America : Market Leader in Smart Meters

North America is poised to maintain its leadership in the Residential Smart Electric Meter Market, holding a significant market share of 12.05 in 2024. The growth is driven by increasing energy efficiency initiatives, regulatory support for smart grid technologies, and rising consumer demand for real-time energy monitoring. Government incentives and funding programs are further catalyzing the adoption of smart meters across residential sectors.

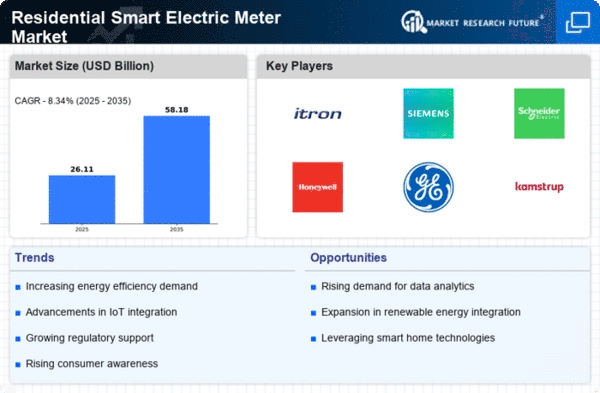

The competitive landscape in North America is robust, featuring key players such as Itron, Honeywell, and General Electric. These companies are leveraging advanced technologies to enhance meter functionalities and improve customer engagement. The U.S. and Canada are leading the charge, with numerous pilot projects and state-level mandates pushing for widespread smart meter deployment. This region's focus on innovation and sustainability positions it as a critical player in the global market.

Europe : Emerging Market with Regulations

Europe is witnessing a significant transformation in the Residential Smart Electric Meter Market, with a market size of 7.25. The region's growth is fueled by stringent EU regulations aimed at enhancing energy efficiency and reducing carbon emissions. The European Commission's directives encourage member states to implement smart metering systems, thereby driving demand and adoption across residential sectors.

Leading countries such as Germany, France, and the UK are at the forefront of this transition, with major players like Siemens and Schneider Electric actively participating in the market. The competitive landscape is characterized by a mix of established firms and innovative startups, all striving to meet the regulatory requirements and consumer expectations. The emphasis on sustainability and energy management is reshaping the market dynamics in Europe.

Asia-Pacific : Rapid Growth in Smart Metering

Asia-Pacific is emerging as a significant player in the Residential Smart Electric Meter Market, with a market size of 4.8. The region's growth is driven by rapid urbanization, increasing energy consumption, and government initiatives aimed at modernizing energy infrastructure. Countries like China and India are investing heavily in smart grid technologies, which is expected to boost the adoption of smart meters in residential areas.

The competitive landscape is evolving, with local and international players vying for market share. Companies such as Kamstrup and Elster are expanding their presence in the region, capitalizing on the growing demand for energy-efficient solutions. The focus on technological advancements and regulatory support is likely to propel the market forward, making Asia-Pacific a key region for future growth in smart metering.

Middle East and Africa : Nascent Market with Potential

The Middle East and Africa region is still in the nascent stages of the Residential Smart Electric Meter Market, with a market size of 0.1. However, there is significant potential for growth driven by increasing energy demands and the need for improved energy management systems. Governments are beginning to recognize the importance of smart metering in enhancing energy efficiency and reliability, which could lead to future investments in this sector.

Countries like South Africa and the UAE are exploring smart grid initiatives, albeit at a slower pace compared to other regions. The competitive landscape is limited, with few key players currently operating. However, as awareness grows and regulatory frameworks develop, the market is expected to attract more investments and innovations, paving the way for future opportunities in smart metering.