North America : Market Leader in Smart Meters

North America is poised to maintain its leadership in the Residential Smart Meter Market, holding a market size of $6.5 billion as of December 2025. The region's growth is driven by increasing energy efficiency initiatives, regulatory mandates for smart grid technologies, and rising consumer demand for real-time energy monitoring. The integration of advanced technologies and IoT solutions further propels market expansion, making it a key player in the global landscape.

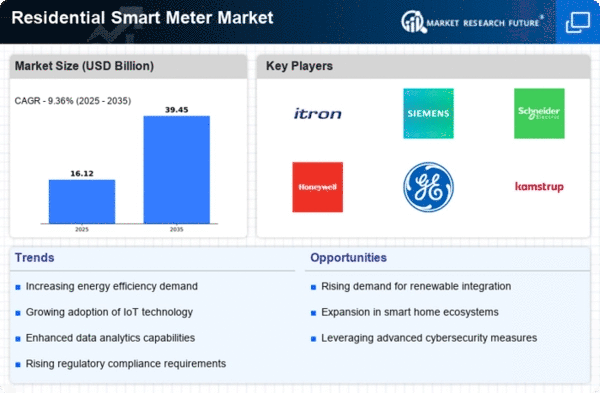

The competitive landscape in North America is characterized by the presence of major players such as Itron, Honeywell, and General Electric. These companies are actively innovating and expanding their product offerings to meet the growing demand. The U.S. and Canada are leading countries in this market, supported by favorable government policies and investments in smart infrastructure. The focus on sustainability and energy conservation continues to shape the market dynamics.

Europe : Emerging Smart Meter Hub

Europe is rapidly evolving into a significant player in the Residential Smart Meter Market, with a market size of $4.5 billion projected for December 2025. The region's growth is primarily driven by stringent EU regulations aimed at enhancing energy efficiency and reducing carbon emissions. The European Commission's initiatives to promote smart grid technologies are pivotal in fostering demand for smart meters across member states, ensuring compliance with energy directives.

Leading countries in Europe include Germany, France, and the UK, where key players like Siemens and Schneider Electric are making substantial investments. The competitive landscape is marked by a mix of established firms and innovative startups, all vying for market share. The emphasis on renewable energy integration and consumer engagement through smart technologies is reshaping the market, positioning Europe as a hub for smart meter advancements.

Asia-Pacific : Rapid Growth in Smart Metering

Asia-Pacific is witnessing significant growth in the Residential Smart Meter Market, with a projected market size of $3.5 billion by December 2025. The region's expansion is fueled by increasing urbanization, rising energy consumption, and government initiatives promoting smart grid technologies. Countries like China and India are at the forefront, implementing policies to enhance energy efficiency and reduce losses in electricity distribution, thereby driving demand for smart meters.

China is the leading country in this market, supported by major players such as Kamstrup and Elster. The competitive landscape is characterized by a mix of local and international companies striving to capture market share. The focus on technological advancements and the integration of IoT solutions are key trends shaping the market dynamics in Asia-Pacific, making it a vital region for future growth.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa region is currently the smallest market for Residential Smart Meters, with a size of $0.24 billion as of December 2025. However, the region holds significant potential for growth driven by increasing investments in smart infrastructure and energy efficiency initiatives. Governments are beginning to recognize the importance of smart metering in managing energy resources effectively, which is expected to catalyze market development in the coming years.

Countries like South Africa and the UAE are leading the charge, with initiatives aimed at modernizing their energy sectors. The competitive landscape is still developing, with a few key players beginning to establish a foothold. As awareness of smart technologies grows, the region is likely to see increased adoption of smart meters, paving the way for future market expansion.