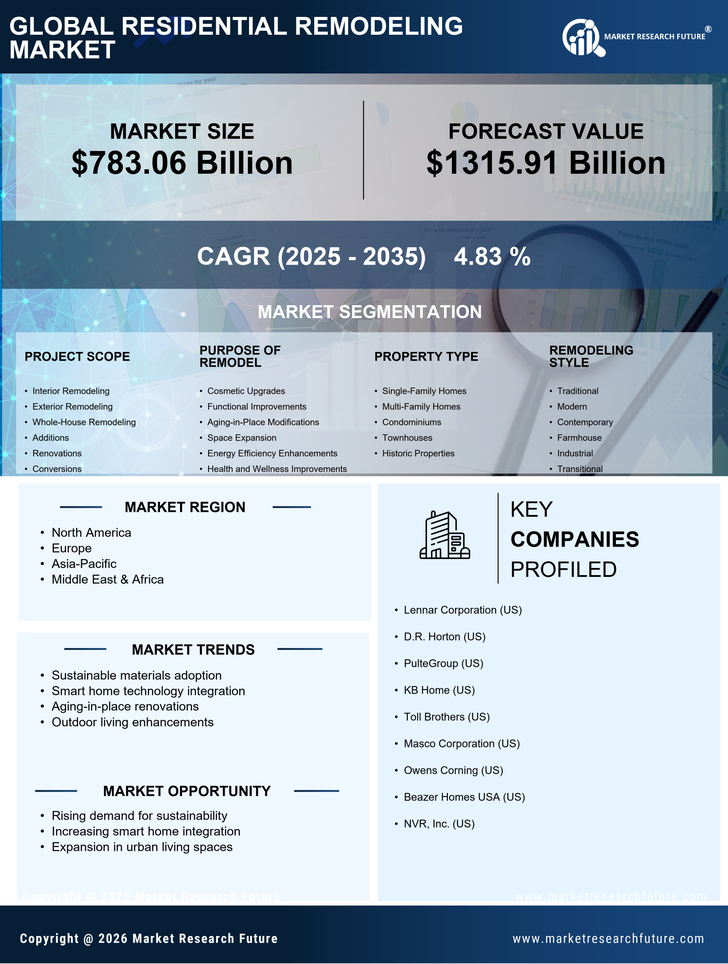

Aging Housing Stock

The Residential Remodeling Market is significantly influenced by the aging housing stock in many areas. A considerable portion of residential properties is over 30 years old, necessitating updates and renovations to meet modern standards. Homeowners are increasingly aware of the need to upgrade outdated systems, such as plumbing and electrical, which can lead to safety hazards. This awareness drives demand for remodeling services, as homeowners seek to enhance their living environments. The potential for substantial investment in renovations indicates a promising outlook for the Residential Remodeling Market, as older homes require extensive remodeling to remain competitive in the market.

Rising Disposable Income

The Residential Remodeling Market is positively impacted by rising disposable income levels among consumers. As individuals experience increased financial flexibility, they are more inclined to invest in home improvements. Data suggests that disposable income has seen a steady rise, allowing homeowners to allocate funds toward remodeling projects. This trend indicates a shift in consumer behavior, where home renovations are viewed as a means of enhancing quality of life. Consequently, the Residential Remodeling Market is likely to thrive as more homeowners prioritize investments in their properties, leading to a diverse range of remodeling projects.

Focus on Energy Efficiency

The Residential Remodeling Market is increasingly shaped by a growing emphasis on energy efficiency. Homeowners are becoming more conscious of their environmental impact and are seeking ways to reduce energy consumption. This trend has led to a rise in demand for energy-efficient upgrades, such as insulation, windows, and HVAC systems. Data indicates that energy-efficient remodeling projects can yield significant long-term savings, making them attractive to homeowners. As a result, the Residential Remodeling Market is likely to see a surge in projects aimed at enhancing energy efficiency, reflecting a broader societal shift towards sustainability.

Increased Homeownership Rates

The Residential Remodeling Market appears to benefit from rising homeownership rates, which have been steadily increasing in various regions. As more individuals acquire homes, the demand for remodeling services intensifies. Homeowners often seek to personalize their living spaces, leading to a surge in renovation projects. According to recent data, homeownership rates have reached approximately 65%, indicating a robust market for remodeling. This trend suggests that as more people invest in their properties, the Residential Remodeling Market is likely to experience sustained growth, driven by the desire for improved functionality and aesthetics in homes.

Technological Advancements in Remodeling

The Residential Remodeling Market is experiencing a transformation due to technological advancements. Innovations such as smart home technology and advanced building materials are reshaping the way remodeling projects are approached. Homeowners are increasingly interested in integrating technology into their living spaces, which can enhance convenience and efficiency. Data shows that the adoption of smart home devices is on the rise, indicating a shift in consumer preferences. This trend suggests that the Residential Remodeling Market will continue to evolve, as contractors and homeowners alike embrace new technologies to create modern, functional living environments.