Regulatory Support and Incentives

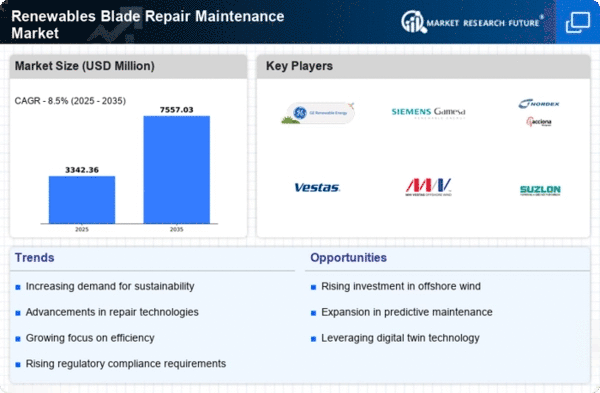

Government policies and incentives play a crucial role in shaping the Global Renewables Blade Repair and Maintenance Market Industry. Many countries are implementing regulations that promote renewable energy adoption, which indirectly boosts the demand for maintenance services. For instance, tax credits and subsidies for renewable energy projects encourage investments in wind and solar farms, leading to an increased need for blade repair and maintenance. This supportive regulatory environment is expected to sustain the market's growth, contributing to a compound annual growth rate of 8.28% from 2025 to 2035, as operators seek to maintain compliance and optimize their assets.

Growing Demand for Renewable Energy

The Global Renewables Blade Repair and Maintenance Market Industry is experiencing heightened demand due to the increasing global shift towards renewable energy sources. As countries strive to meet their carbon reduction targets, investments in wind and solar energy are surging. This trend is evidenced by the projected market size of 12.5 USD Billion in 2024, reflecting a robust commitment to sustainable energy solutions. The need for efficient blade repair and maintenance services becomes paramount as the number of operational wind turbines and solar installations rises, necessitating regular upkeep to ensure optimal performance and longevity.

Aging Infrastructure and Maintenance Needs

The aging infrastructure of existing renewable energy installations is a significant driver for the Global Renewables Blade Repair and Maintenance Market Industry. As many wind turbines and solar panels reach the end of their initial operational life, the demand for repair and maintenance services escalates. Aging blades are more susceptible to wear and tear, necessitating regular inspections and repairs to maintain efficiency. This trend is compounded by the increasing number of installations worldwide, which amplifies the need for specialized maintenance services. Consequently, the market is poised for growth as operators prioritize the longevity and performance of their renewable assets.

Technological Advancements in Repair Techniques

Innovations in repair technologies are significantly influencing the Global Renewables Blade Repair and Maintenance Market Industry. Advanced materials and techniques, such as drone inspections and automated repair systems, enhance the efficiency and effectiveness of maintenance operations. These technological advancements not only reduce downtime but also lower operational costs, making maintenance more accessible for operators. As the industry evolves, the integration of smart technologies is likely to become commonplace, further driving the demand for specialized repair services. This trend aligns with the anticipated growth trajectory of the market, projected to reach 30 USD Billion by 2035.

Environmental Awareness and Sustainability Goals

Heightened environmental awareness among consumers and businesses is propelling the Global Renewables Blade Repair and Maintenance Market Industry. As stakeholders increasingly prioritize sustainability, the demand for renewable energy solutions continues to rise. This shift is prompting operators to invest in maintenance services that ensure their renewable assets operate at peak efficiency, thereby maximizing energy output and minimizing environmental impact. The growing emphasis on sustainability aligns with the projected market growth, as organizations seek to enhance their green credentials while adhering to regulatory requirements. This trend underscores the importance of effective blade maintenance in achieving broader sustainability objectives.