Public Awareness and Education

Public awareness and education regarding renewable energy are essential drivers of the Renewable Energy Transition Market. As communities become more informed about the benefits of renewable energy, there is a growing demand for sustainable energy solutions. Educational campaigns and initiatives aimed at promoting renewable energy technologies have gained traction, leading to increased public support for clean energy projects. In 2023, surveys indicated that over 70% of the population in various regions expressed a preference for renewable energy sources over fossil fuels. This heightened awareness is likely to influence policy decisions and consumer behavior, further propelling the transition within the Renewable Energy Transition Market.

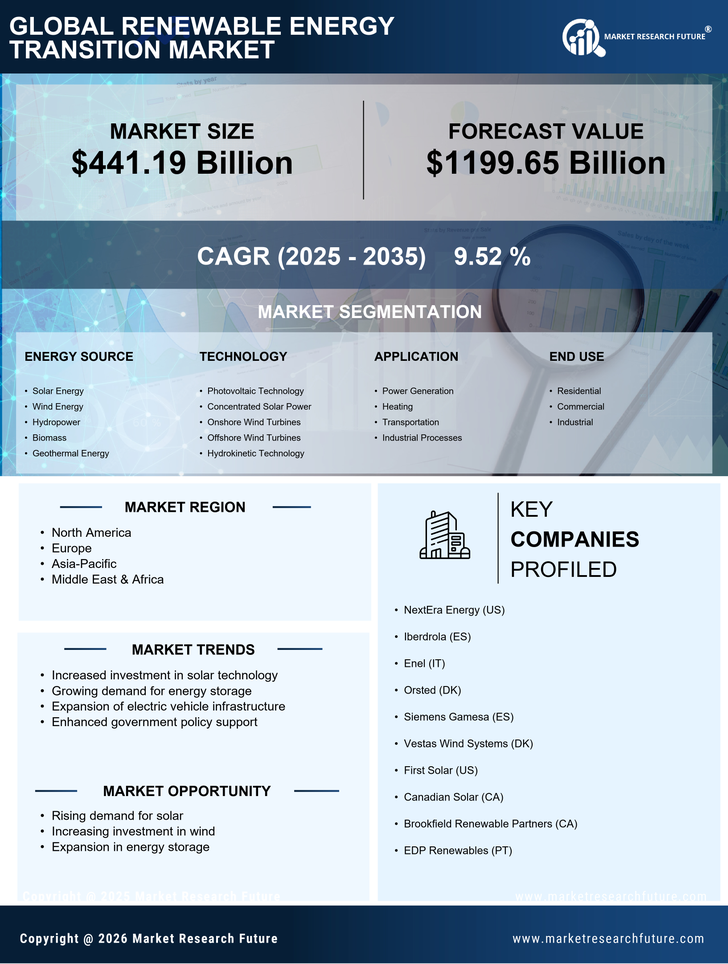

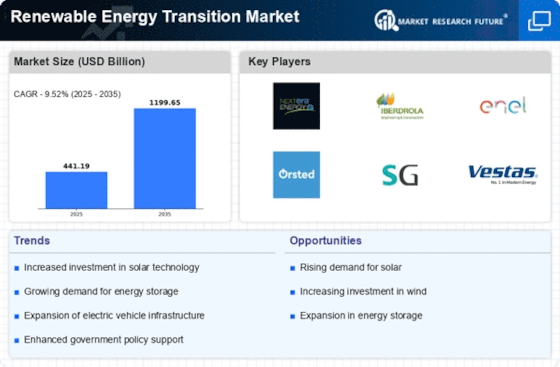

Increasing Demand for Clean Energy

The Renewable Energy Transition Market is experiencing a notable surge in demand for clean energy solutions. This trend is driven by heightened awareness of climate change and the need for sustainable energy sources. According to recent data, renewable energy sources accounted for approximately 29% of global electricity generation in 2023, a figure that is expected to rise as more countries commit to reducing carbon emissions. The transition towards cleaner energy is not merely a trend but a necessity, as governments and corporations alike recognize the importance of sustainable practices. This increasing demand is likely to propel investments in renewable technologies, thereby fostering growth within the Renewable Energy Transition Market.

Government Incentives and Subsidies

Government incentives and subsidies play a critical role in shaping the Renewable Energy Transition Market. Many governments are implementing policies to promote the adoption of renewable energy technologies, including tax credits, grants, and feed-in tariffs. For instance, in 2023, several countries introduced new subsidy programs aimed at increasing solar and wind energy installations. These financial incentives lower the barriers to entry for renewable energy projects, making them more attractive to investors and developers. As these supportive policies continue to evolve, they are expected to significantly enhance the growth prospects of the Renewable Energy Transition Market.

Corporate Sustainability Initiatives

The Renewable Energy Transition Market is increasingly influenced by corporate sustainability initiatives. Many companies are setting ambitious targets to achieve net-zero emissions, which often necessitates a shift towards renewable energy sources. In 2023, over 1,500 companies worldwide committed to 100% renewable energy, reflecting a growing trend among businesses to prioritize sustainability. This corporate shift not only drives demand for renewable energy but also encourages innovation and investment in clean technologies. As corporations recognize the long-term benefits of sustainable practices, their commitment to renewable energy is likely to accelerate the transition within the Renewable Energy Transition Market.

Advancements in Energy Storage Technologies

Energy storage technologies are pivotal in the Renewable Energy Transition Market, as they address the intermittency issues associated with renewable energy sources. Innovations in battery technologies, such as lithium-ion and solid-state batteries, have significantly improved energy storage capabilities. In 2023, The Renewable Energy Transition Market was valued at approximately 10 billion USD, with projections indicating a compound annual growth rate of over 20% through 2030. These advancements not only enhance the reliability of renewable energy systems but also facilitate the integration of renewable sources into existing energy grids. As energy storage solutions become more efficient and cost-effective, they are likely to play a crucial role in the ongoing transition towards renewable energy.