Research Methodology on Renal Disease Market

1. Introduction

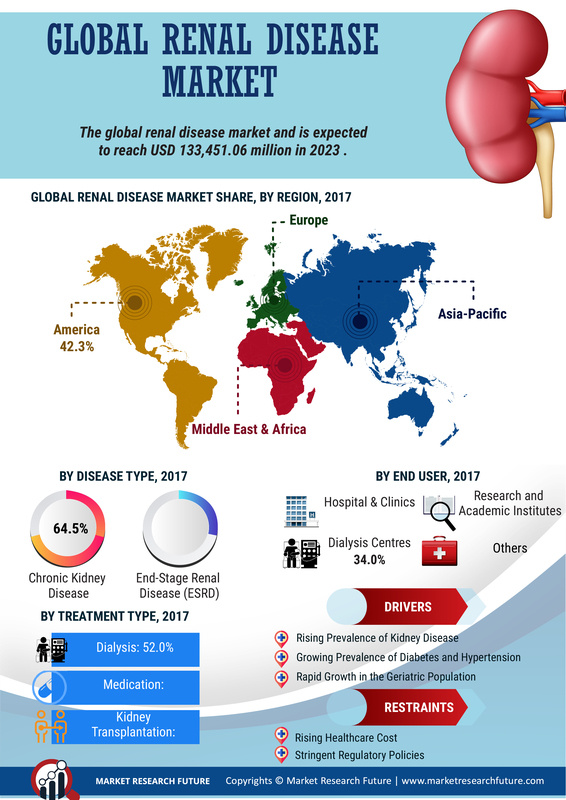

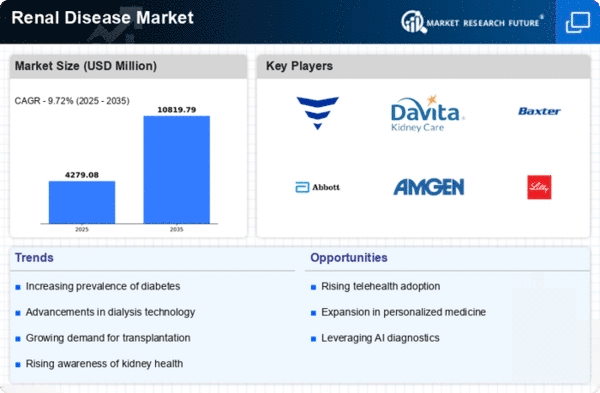

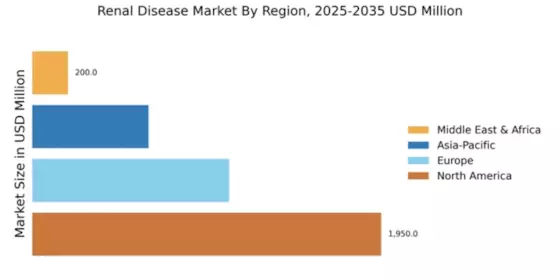

The purpose of this research is to assess the impact of renal disease on the global market. The research question is, what are the factors influencing the development of renal disease markets worldwide? Specifically, we will examine the prevalence and type of renal disease, the factors contributing to its growth, the change in trends in its diagnosis and treatment and the role of local, national and international healthcare organizations in the management and prevention of renal disease.

2. Research design

The research approach adopted in this study is qualitative in nature. Qualitative research is chosen due to the lack of quantitative data regarding the renal disease market and to obtain an in-depth understanding of the factors influencing its growth. This research design allows for a more detailed exploration and analysis of the current situation and the scope for further development.

The need to collect primary and secondary data from a variety of sources is a crucial aspect of this research. To provide a comprehensive analysis of the topic, this work is based on interviews with health professionals and experts in the field of renal disease, a review of relevant literature and archived documents, online surveys and reports by various healthcare organizations. Secondary data collection will include industry reports and other resources.

3. Sampling

The demographic profile of the sample population varies depending on the specific source used. For example, interviews are conducted with qualified health professionals and experts who have experience with the diagnosis, treatment and management of renal disease, while surveys are designed to gain a broad representation of geographical regions, different income and social backgrounds, and an overall gender breakdown.

4. Data collection

The data collection process includes:

- Interviews: This will be conducted with qualified health professionals and experts with experience in the diagnosis, treatment and management of renal disease. The interviews will last for around 30 minutes and will cover topics such as the prevalence and type of renal disease, the factors contributing to its growth, changes in trends in its diagnosis and treatment and the role of local, national and international healthcare organisations in the management and prevention of renal disease.

- Archival documents: Information is collected from archived documents such as industry reports, national and international statistics and relevant literature.

- Online surveys: This allows for a more general yet thorough analysis as respondents will be asked to provide detailed answers to questions on the current market situation, their personal experience and opinion on the growth of renal disease, and their views on the local, national and international policies highlighting the management and prevention of the disease.

- Reports from healthcare organizations: Reports from both local and national healthcare organisations such as the Centers for Disease Control and Prevention (CDC) are consulted and included.

5. Data analysis

The data collected is analyzed using a variety of analytical and data processing techniques. Descriptive analyses will be used to present the overall picture of the renal disease market. The narrative analysis will be applied to examine the opinions and experiences of the interview and survey respondents. Qualitative data analysis is used to uncover the nuances and underlying motivations of the respondents. Regression analysis is employed to identify the correlations between different factors.

6. Conclusion

This study assesses the impact of renal disease on the global market. It is based on qualitative research that looks into the prevalence and type of renal disease, the factors contributing to its growth, changes in trends in its diagnosis and treatment and the role of local, national and international healthcare organisations in the management and prevention of renal disease. Primary data is obtained through interviews and surveys while secondary data will be collected from archived documents, industry reports and other resources. The data collected is analyzed through a variety of techniques with a particular focus on qualitative data analysis to identify the nuances and underlying motivations of the respondents.