Technological Advancements

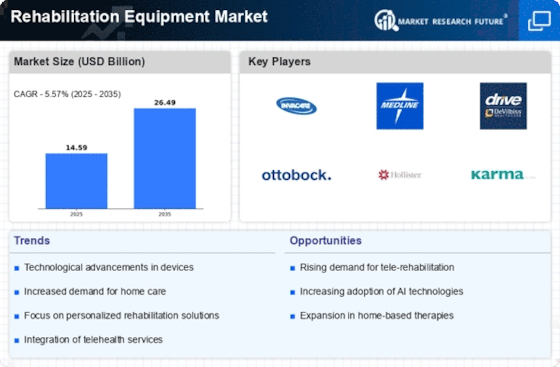

The Rehabilitation Equipment Market is experiencing a surge in technological advancements that enhance the efficacy of rehabilitation processes. Innovations such as robotic exoskeletons, virtual reality, and tele-rehabilitation tools are becoming increasingly prevalent. These technologies not only improve patient outcomes but also streamline the rehabilitation process, making it more efficient. For instance, the integration of AI in rehabilitation equipment allows for personalized treatment plans, which can lead to better recovery rates. The market for rehabilitation robotics alone is projected to reach USD 2.5 billion by 2026, indicating a robust growth trajectory. As these technologies continue to evolve, they are likely to play a pivotal role in shaping the future of the Rehabilitation Equipment Market.

Government Initiatives and Funding

Government initiatives and funding play a crucial role in the Rehabilitation Equipment Market, as they often provide the necessary financial support for research and development. Various governments are recognizing the importance of rehabilitation services in improving public health outcomes and are allocating funds to enhance these services. For example, initiatives aimed at increasing access to rehabilitation equipment for underserved populations are gaining traction. In some regions, government programs are providing subsidies for rehabilitation equipment, making it more accessible to patients. This financial backing not only stimulates market growth but also encourages innovation within the industry. As governments continue to prioritize rehabilitation services, the Rehabilitation Equipment Market is likely to benefit from increased investment and support.

Rising Incidence of Chronic Diseases

The Rehabilitation Equipment Market is significantly influenced by the rising incidence of chronic diseases, which necessitate ongoing rehabilitation services. Conditions such as stroke, arthritis, and cardiovascular diseases are becoming increasingly common, leading to a higher demand for rehabilitation equipment. According to recent statistics, approximately 60% of adults with chronic conditions require some form of rehabilitation. This trend is expected to drive the market as healthcare providers seek effective solutions to manage these conditions. The increasing prevalence of obesity and sedentary lifestyles further exacerbates this issue, creating a pressing need for rehabilitation services. Consequently, the Rehabilitation Equipment Market is poised for growth as it adapts to meet the needs of this expanding patient population.

Growing Awareness of Rehabilitation Benefits

The growing awareness of the benefits of rehabilitation is a significant driver for the Rehabilitation Equipment Market. As healthcare professionals and patients alike recognize the importance of rehabilitation in recovery and quality of life, the demand for specialized equipment is increasing. Educational campaigns and advocacy efforts are helping to inform the public about the advantages of rehabilitation, leading to a more proactive approach to health management. This heightened awareness is particularly evident in the aging population, where there is a greater emphasis on maintaining mobility and independence. As more individuals seek rehabilitation services, the Rehabilitation Equipment Market is expected to expand, driven by the need for effective and accessible rehabilitation solutions.

Increased Investment in Healthcare Infrastructure

Increased investment in healthcare infrastructure is a pivotal factor influencing the Rehabilitation Equipment Market. As countries strive to enhance their healthcare systems, there is a concerted effort to improve rehabilitation services and facilities. This investment often translates into the procurement of advanced rehabilitation equipment, which is essential for delivering high-quality care. For instance, hospitals and rehabilitation centers are increasingly upgrading their facilities to include state-of-the-art equipment that meets the evolving needs of patients. The global healthcare expenditure is projected to reach USD 10 trillion by 2025, indicating a substantial commitment to improving healthcare services. This trend is likely to bolster the Rehabilitation Equipment Market as more resources are allocated to enhance rehabilitation capabilities.