Aging Population

The increasing aging population is a primary driver of the home rehabilitation product Market. As individuals age, they often experience a decline in mobility and physical health, necessitating rehabilitation products to aid in recovery and daily living. According to recent statistics, the proportion of individuals aged 65 and older is projected to rise significantly, leading to a heightened demand for home rehabilitation solutions. This demographic shift suggests that the Home Rehabilitation Product Market will likely expand as more seniors seek to maintain independence and quality of life through effective rehabilitation tools. Furthermore, the growing awareness of the importance of rehabilitation in enhancing life quality among older adults contributes to this trend, indicating a robust market potential.

Rising Healthcare Costs

Rising healthcare costs are increasingly influencing the Home Rehabilitation Product Market. As healthcare expenses continue to escalate, individuals and families are seeking cost-effective solutions for rehabilitation that can be implemented at home. This trend is particularly evident as patients aim to reduce hospital visits and associated costs. The Home Rehabilitation Product Market is responding to this demand by offering a range of affordable products that facilitate recovery in a home setting. Additionally, insurance companies are beginning to recognize the value of home rehabilitation, potentially leading to increased coverage for these products. This shift suggests that the market may experience growth as more consumers prioritize home-based rehabilitation solutions to manage their health effectively.

Technological Advancements

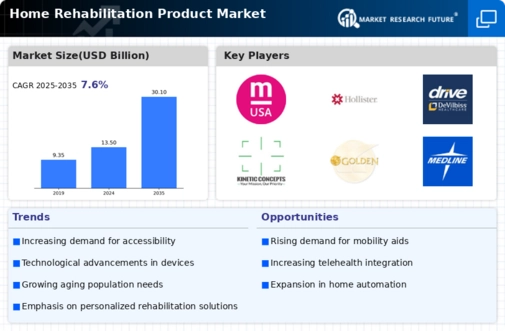

Technological advancements play a crucial role in shaping the Home Rehabilitation Product Market. Innovations such as smart devices, telehealth platforms, and wearable technology are transforming how rehabilitation is delivered and monitored. For instance, the integration of artificial intelligence and machine learning into rehabilitation products allows for personalized therapy regimens tailored to individual needs. This trend not only enhances the effectiveness of rehabilitation but also increases user engagement. Market data indicates that the adoption of technology in rehabilitation is expected to grow, with a significant portion of consumers expressing interest in tech-enabled solutions. As these advancements continue to evolve, they are likely to drive growth in the Home Rehabilitation Product Market, making rehabilitation more accessible and efficient.

Shift Towards Preventive Healthcare

The shift towards preventive healthcare is emerging as a vital driver for the Home Rehabilitation Product Market. As healthcare systems increasingly emphasize prevention over treatment, there is a growing focus on rehabilitation as a means to prevent further health complications. This trend encourages individuals to invest in rehabilitation products that support ongoing health and wellness. Market data suggests that consumers are more inclined to adopt preventive measures, including home rehabilitation solutions, to maintain their physical health. This proactive approach not only aids in recovery but also promotes long-term well-being. Consequently, the Home Rehabilitation Product Market is poised for growth as more individuals recognize the importance of rehabilitation in their overall health strategy.

Increased Awareness of Rehabilitation Benefits

There is a growing awareness of the benefits of rehabilitation, which serves as a significant driver for the Home Rehabilitation Product Market. Educational campaigns and advocacy efforts have highlighted the importance of rehabilitation in recovery from injuries, surgeries, and chronic conditions. This heightened awareness is leading to an increase in demand for home rehabilitation products, as individuals seek to take control of their recovery processes. Market Research Future indicates that consumers are more informed about the options available to them, resulting in a shift towards home-based solutions. As awareness continues to spread, the Home Rehabilitation Product Market is likely to see sustained growth, with more individuals recognizing the value of investing in rehabilitation products.