Regulatory Compliance

Regulatory compliance is increasingly influencing the refrigeration lubricant market. Stricter regulations regarding the use of refrigerants and lubricants are prompting manufacturers to adapt their products accordingly. Compliance with environmental standards, such as those set by the Environmental Protection Agency, is essential for market players. This has led to the development of lubricants that are compatible with low-GWP refrigerants, ensuring that companies can meet legal requirements while maintaining operational efficiency. The need for compliance is expected to drive innovation and investment in the refrigeration lubricant market, as businesses seek to align with evolving regulations.

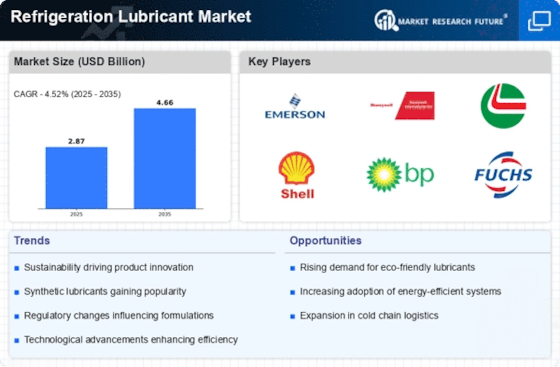

Technological Innovations

Technological advancements are playing a pivotal role in shaping the refrigeration lubricant market. Innovations in formulation and production processes are leading to the development of high-performance lubricants that enhance efficiency and reduce energy consumption. For instance, the introduction of synthetic lubricants has improved thermal stability and reduced wear in refrigeration systems. Market data indicates that the synthetic lubricant segment is expected to capture a significant share, potentially exceeding 40% by 2026. As technology continues to evolve, the refrigeration lubricant market is poised for further growth driven by enhanced product performance and reliability.

Sustainability Initiatives

The increasing emphasis on sustainability within the refrigeration lubricant market is driving demand for eco-friendly lubricants. Manufacturers are focusing on developing biodegradable and non-toxic lubricants to meet regulatory standards and consumer preferences. This shift is evident as companies invest in research and development to create products that minimize environmental impact. The market for sustainable refrigeration lubricants is projected to grow, with estimates suggesting a compound annual growth rate of over 5% in the coming years. As businesses strive to reduce their carbon footprint, the refrigeration lubricant market is likely to see a surge in demand for sustainable solutions.

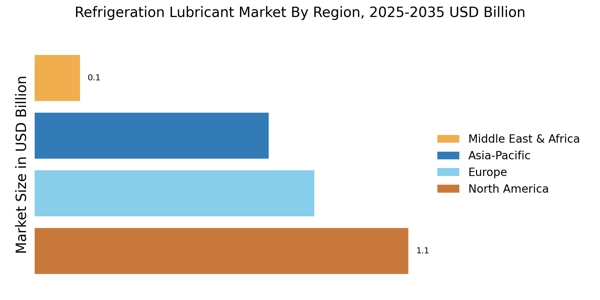

Rising Demand in Emerging Markets

Emerging markets are witnessing a surge in demand for refrigeration lubricants, significantly impacting the refrigeration lubricant market. Rapid urbanization and industrialization in regions such as Asia-Pacific and Latin America are driving the need for efficient refrigeration systems. Market analysis suggests that the Asia-Pacific region alone could account for over 30% of the total market share by 2027. This growth is fueled by increasing consumer demand for refrigeration in sectors such as food and beverage, pharmaceuticals, and retail. As these markets expand, the refrigeration lubricant market is likely to experience robust growth opportunities.

Diverse Applications Across Industries

The versatility of refrigeration lubricants across various industries is a key driver for the refrigeration lubricant market. These lubricants are utilized in a wide range of applications, including commercial refrigeration, automotive air conditioning, and industrial cooling systems. The food and beverage sector, in particular, is a significant contributor to market growth, as the need for reliable refrigeration solutions continues to rise. Market data indicates that the commercial refrigeration segment is projected to grow at a CAGR of approximately 4% through 2025. This diverse applicability ensures a steady demand for refrigeration lubricants, reinforcing their importance in the market.