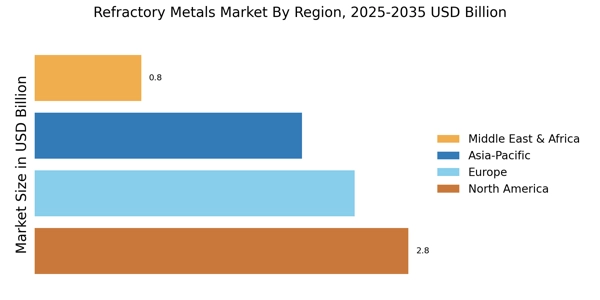

North America : Innovation and Demand Surge

North America is witnessing significant growth in the refractory metals market, driven by increasing demand from aerospace, automotive, and electronics sectors. The region holds approximately 35% of the global refractory metal market share, making it the largest market for refractory metals. Regulatory support for advanced manufacturing and sustainable practices further fuels this growth, as companies seek to innovate and improve efficiency.

The United States is the leading country in this region, with major players like Global Tungsten & Powders Corp and Molybdenum Corp dominating the landscape. The competitive environment is characterized by a focus on technological advancements and strategic partnerships. Canada also plays a vital role, contributing to the market with its mining capabilities and resource availability, enhancing the overall supply chain in North America.

Europe : Manufacturing Powerhouse in Refractory Metals Market

Europe is a key player in the refractory metals market, accounting for approximately 30% of the global share, making it the second-largest market. The region benefits from a robust manufacturing base, particularly in Germany and Austria, where industries are increasingly adopting advanced materials for high-performance applications. Regulatory frameworks promoting sustainability and innovation are pivotal in driving market growth.

Germany leads the European market, with companies like H.C. Starck GmbH and Plansee SE at the forefront. The competitive landscape is marked by a strong emphasis on research and development, with many firms investing in new technologies to enhance product performance. Additionally, the presence of skilled labor and advanced manufacturing techniques positions Europe favorably in the global refractory metal market.

Asia-Pacific : Emerging Market with High Potential

Asia-Pacific is rapidly emerging as a significant player in the refractory metals market, holding approximately 25% of the global share. The region's growth is driven by increasing industrialization, particularly in countries like China and India, where demand for refractory metals is surging in sectors such as construction and electronics. Government initiatives aimed at boosting manufacturing capabilities are also contributing to market expansion.

China is the dominant force in this region, with companies like Ningbo Jiangfeng and Xiamen Tungsten Co., Ltd. leading the refractory metal market. The competitive landscape is characterized by a mix of established players and new entrants, all vying for market share. Additionally, the region's focus on technological advancements and sustainable practices is shaping the future of the refractory metals market in Asia-Pacific.

Middle East and Africa : Resource-Rich Frontier for Metals

The Middle East and Africa region is gradually establishing itself in the refractory metals market, currently holding about 10% of the global share. The growth is primarily driven by the region's rich mineral resources and increasing investments in mining and metallurgy. Countries like South Africa and the UAE are focusing on developing their industrial capabilities, which is expected to enhance market dynamics in the coming years.

South Africa is a key player in this region, with a strong presence of mining companies and a growing focus on refining and processing refractory metals. The competitive landscape is evolving, with both local and international players seeking to capitalize on the region's resources. Additionally, government initiatives aimed at promoting industrial growth are likely to further boost the market in the Middle East and Africa.