Market Analysis

In-depth Analysis of Reduced Sugar food beverage Market Industry Landscape

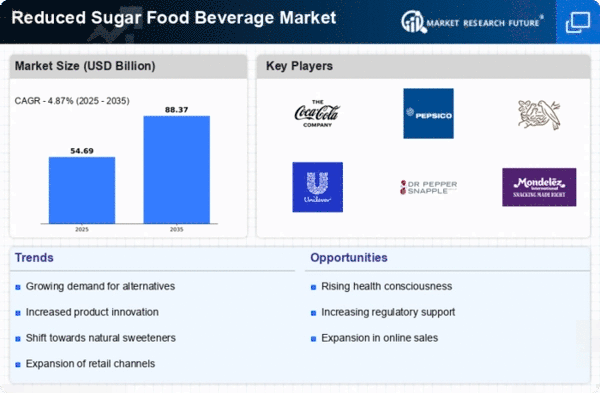

The Reduced Sugar Food and Beverage Market is experiencing significant trends that mirror the changing consumer landscape and a heightened focus on health and wellness. One of the predominant trends is the increasing demand for products with reduced sugar content. As health-conscious consumers seek ways to manage their sugar intake, food and beverage manufacturers are responding by reformulating products to offer reduced sugar alternatives. This trend aligns with the global movement towards healthier lifestyles and the recognition that excessive sugar consumption is linked to various health issues, including obesity and diabetes.

The demand for reduced sugar options is driving innovation in the food and beverage industry. Manufacturers are exploring a variety of sugar-reducing ingredients and technologies to maintain the taste and quality of their products while meeting consumer expectations for lower sugar content. Natural sweeteners like stevia, monk fruit, and erythritol are gaining popularity as they provide sweetness without the calorie load associated with traditional sugars. Additionally, advancements in ingredient technology, such as the use of sugar alcohols and novel plant-based sweeteners, contribute to the development of reduced sugar formulations across various product categories.

The Reduced Sugar Food and Beverage Market is witnessing a surge in product diversification, spanning from traditionally high-sugar items like carbonated beverages and breakfast cereals to sauces, snacks, and even bakery products. This expansion reflects the industry's response to consumer demands for reduced sugar options in a wide array of everyday food and beverage choices. The shift towards offering reduced sugar alternatives is not limited to specific product categories but has become a pervasive trend across the entire spectrum of the market.

In addition to meeting consumer preferences for healthier options, the Reduced Sugar Food and Beverage Market is influenced by regulatory measures and guidelines. Governments and health organizations worldwide are implementing initiatives to address rising concerns about obesity and diet-related health issues. These regulatory interventions often include recommendations to reduce sugar content in food and beverage products. Manufacturers are proactively adjusting their formulations to comply with these regulations, contributing to the overall momentum towards reduced sugar options in the market.

The growing awareness of the impact of sugar on overall well-being is leading to increased scrutiny of product labels. Consumers are becoming more adept at reading nutritional information and actively seeking products with lower sugar content. This heightened awareness is driving the adoption of reduced sugar options as consumers make informed choices to support their health goals. Brands that transparently communicate their commitment to reduced sugar formulations are likely to gain consumer trust and loyalty in this evolving market landscape.

Sustainability is emerging as a noteworthy trend within the Reduced Sugar Food and Beverage Market. Consumers are not only concerned about their personal health but are increasingly mindful of the environmental impact of their food choices. Manufacturers are responding by incorporating sustainable sourcing practices, eco-friendly packaging, and responsible production methods into their reduced sugar product lines. This dual focus on health and sustainability resonates with a growing segment of conscious consumers who seek products that align with both personal and planetary well-being.

Leave a Comment