North America : Sustainable Innovation Leader

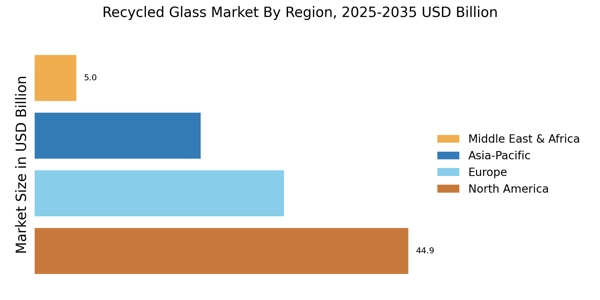

Regional adoption patterns play a critical role in shaping the global market for recycled glass. Regional government incentives are supporting the growth of the market for recycled glass globally. North America is the largest market for recycled glass, holding approximately 45% of the global share. The region's growth is driven by increasing environmental awareness, stringent regulations on waste management, and a rising demand for sustainable packaging solutions. The U.S. and Canada are the primary contributors in market for recycled glass, with policies promoting recycling initiatives and investments in advanced recycling technologies.

The competitive landscape is characterized by key players such as O-I Glass Inc and Strategic Materials, which are leading the charge in innovation and capacity expansion in market for recycled glass. The presence of established recycling infrastructure and government support further enhances market for recycled glass dynamics. As consumer preferences shift towards eco-friendly products, the recycled glass market is poised for significant growth in North America.

Europe : Circular Economy Advocate

Europe is the second-largest market for recycled glass, accounting for about 30% of the global share. The region's growth is significantly influenced by the European Union's commitment to a circular economy, which emphasizes recycling and waste reduction. Regulations such as the Waste Framework Directive and the Packaging and Packaging Waste Directive are pivotal in driving demand for recycled materials, including glass. Europe’s emphasis on a circular economy continues to strengthen the market for recycled glass in the region.

Leading countries in the market for recycled glass include Germany, France, and the UK, where robust recycling systems and public awareness campaigns are prevalent. Key players like Ardagh Group and Verallia are actively investing in sustainable practices and expanding their recycling capabilities. The competitive landscape for market for recycled glass is marked by collaboration between governments and private sectors to enhance recycling rates and reduce landfill waste.

Asia-Pacific : Emerging Market Potential

Asia-Pacific is witnessing rapid growth in the recycled glass market, holding approximately 20% of the global market for recycled glass share. The region's expansion is driven by increasing urbanization, rising consumer awareness about sustainability, and government initiatives promoting recycling. Countries like China and India are leading this growth, with significant investments in recycling infrastructure and technology to meet the rising demand for eco-friendly packaging solutions and profiting the market for recycled glass. Emerging economies in Asia-Pacific are expected to see rapid expansion in the market for recycled glass, fueled by urbanization and sustainability initiatives.

The competitive landscape is evolving, with local players and international companies entering the market for recycled glass. Key players such as Pinnacle Recycling and Strategic Materials are expanding their operations to cater to the growing demand for market for recycled glass. As regulations become more stringent, the focus on recycling and sustainable practices is expected to intensify, further propelling market for recycled glass growth in Asia-Pacific.

Middle East and Africa : Resource-Rich Frontier

The Middle East and Africa region is gradually emerging in the recycled glass market, holding about 5% of the global share. The growth is primarily driven by increasing awareness of environmental issues and the need for sustainable waste management solutions. Countries like South Africa and the UAE are taking significant steps to enhance recycling rates through government initiatives and public-private partnerships aimed at improving waste management practices. Middle East and Africa are witnessing gradual adoption, presenting untapped potential in the market for recycled glass.

The competitive landscape is still developing, with local companies and international players exploring opportunities in the region for market for recycled glass. Key players such as Glass Recycling Company and Sappi Lanaken are beginning to establish their presence. As the region continues to invest in recycling infrastructure and technology, the market for recycled glass is expected to grow, driven by both regulatory support and consumer demand for sustainable products.