Technological Innovations

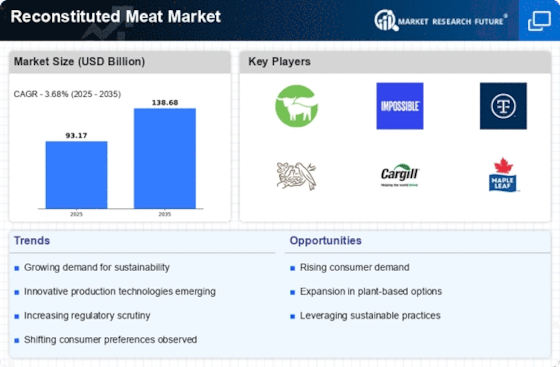

Technological advancements are playing a pivotal role in shaping the Reconstituted Meat Market. Innovations in food processing and production techniques are enabling manufacturers to create more palatable and nutritious meat alternatives. For instance, the use of 3D printing technology in food production is gaining traction, allowing for the creation of complex textures and flavors that mimic traditional meat. Market data indicates that investment in food technology has increased by 30% in the last two years, reflecting the industry's commitment to innovation. As these technologies continue to evolve, they are likely to enhance the quality and appeal of reconstituted meat products, thereby attracting a broader consumer base and driving market growth.

Changing Dietary Preferences

The Reconstituted Meat Market is witnessing a transformation in dietary preferences, with a growing number of consumers adopting flexitarian, vegetarian, and vegan diets. This shift is driven by various factors, including health concerns, ethical considerations, and environmental awareness. Market Research Future indicates that approximately 40% of consumers are actively reducing their meat consumption, leading to an increased demand for reconstituted meat products that provide similar taste and texture. This trend is prompting manufacturers to diversify their product offerings, catering to a wider audience. As dietary preferences continue to evolve, the Reconstituted Meat Market is likely to adapt, focusing on creating innovative products that appeal to both traditional meat eaters and those seeking plant-based alternatives.

Health-Conscious Consumerism

The Reconstituted Meat Market is experiencing a notable shift driven by the increasing health consciousness among consumers. Individuals are becoming more aware of the nutritional content of their food, leading to a demand for meat alternatives that offer lower fat and higher protein content. This trend is reflected in market data, which indicates that the demand for reconstituted meat products has surged by approximately 25% over the past year. Consumers are actively seeking options that align with their health goals, prompting manufacturers to innovate and create products that cater to these preferences. As a result, the Reconstituted Meat Market is likely to continue evolving, with a focus on enhancing the nutritional profile of meat alternatives to meet the expectations of health-conscious consumers.

Regulatory Support and Standards

The Reconstituted Meat Market is benefiting from an evolving regulatory landscape that supports the development and commercialization of meat alternatives. Governments are increasingly recognizing the potential of reconstituted meat to address food security and environmental challenges. Regulatory frameworks are being established to ensure product safety and quality, which in turn fosters consumer confidence. Recent data suggests that countries implementing supportive regulations have seen a 20% increase in the market share of reconstituted meat products. This regulatory support not only encourages innovation but also facilitates market entry for new players, thereby enhancing competition within the Reconstituted Meat Market. As regulations continue to evolve, they may further influence the industry's growth trajectory.

Sustainability and Ethical Sourcing

Sustainability concerns are increasingly influencing consumer choices, thereby impacting the Reconstituted Meat Market. As awareness of environmental issues grows, consumers are gravitating towards products that are perceived as more sustainable. Reconstituted meat, often produced with a lower carbon footprint compared to traditional meat, appeals to environmentally conscious individuals. Market analysis suggests that approximately 60% of consumers are willing to pay a premium for sustainably sourced products. This trend is prompting companies within the Reconstituted Meat Market to adopt ethical sourcing practices and transparent supply chains, which not only enhance brand loyalty but also contribute to a more sustainable food system. The industry's response to these demands may shape its future trajectory significantly.