Technological Innovations

Technological advancements play a crucial role in shaping the Rapid Microbiology Testing Market. Innovations such as automated systems, advanced molecular techniques, and portable testing devices are enhancing the accuracy and speed of microbiological tests. These technologies not only streamline laboratory workflows but also reduce the risk of human error. The introduction of next-generation sequencing and real-time PCR has revolutionized pathogen detection, allowing for more precise identification of microorganisms. As a result, laboratories are increasingly adopting these technologies to meet the growing demand for rapid testing solutions, thereby driving market growth. The integration of artificial intelligence in data analysis further enhances the capabilities of rapid testing, indicating a promising future for the industry.

Growing Healthcare Expenditure

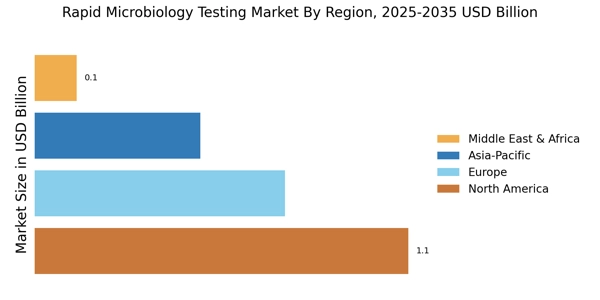

Healthcare expenditure is on the rise, which positively influences the Rapid Microbiology Testing Market. Increased investment in healthcare infrastructure and diagnostic services is facilitating the adoption of rapid testing technologies. Governments and private sectors are allocating more resources towards improving laboratory capabilities, which includes the procurement of rapid microbiology testing equipment. This trend is particularly evident in emerging economies, where healthcare systems are evolving to meet the needs of growing populations. As healthcare providers seek to enhance patient outcomes through timely diagnostics, the demand for rapid microbiology testing is likely to increase. This shift towards advanced diagnostic solutions is expected to propel market growth in the coming years.

Increased Focus on Food Safety

The emphasis on food safety is a significant driver for the Rapid Microbiology Testing Market. With rising consumer awareness regarding foodborne illnesses, regulatory bodies are enforcing stricter safety standards for food products. This has led to an increased adoption of rapid microbiology testing methods in the food industry to ensure compliance with safety regulations. For example, the implementation of rapid testing methods can help identify contaminants in food products quickly, thereby reducing the risk of outbreaks. The market for rapid testing in food safety is expected to expand as manufacturers seek to enhance their quality control processes. This trend underscores the critical role of rapid microbiology testing in safeguarding public health and maintaining consumer trust.

Rising Demand for Rapid Results

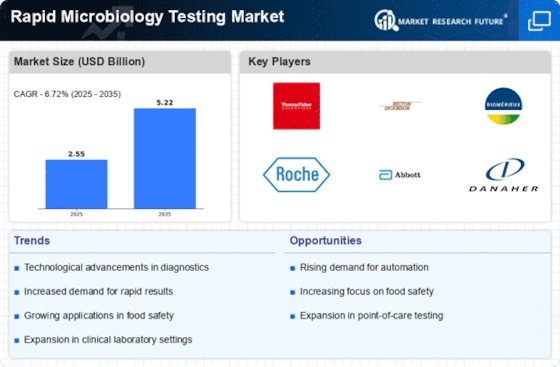

The Rapid Microbiology Testing Market is experiencing a notable increase in demand for rapid results across various sectors, including healthcare and food safety. This demand is driven by the need for timely decision-making in clinical diagnostics and food quality assurance. For instance, the ability to obtain results within hours rather than days can significantly impact patient management and outbreak control. According to recent data, the market for rapid microbiology testing is projected to grow at a compound annual growth rate of approximately 8% over the next few years. This growth reflects a broader trend towards efficiency and speed in microbiological testing, which is essential for maintaining public health and safety.

Regulatory Support and Initiatives

Regulatory support and initiatives are pivotal in driving the Rapid Microbiology Testing Market. Governments and health organizations are promoting the adoption of rapid testing methods to improve public health outcomes. Initiatives aimed at streamlining the approval processes for rapid testing technologies are encouraging manufacturers to innovate and bring new products to market. Furthermore, guidelines established by regulatory bodies emphasize the importance of rapid microbiology testing in outbreak management and disease control. This supportive regulatory environment is likely to foster growth in the market, as stakeholders recognize the value of rapid testing in enhancing diagnostic capabilities and ensuring timely responses to health threats.