North America : Market Leader in Rail Services

North America is poised to maintain its leadership in the Rail Signaling System Repair and MRO Services Market, holding a market size of $2.6B in 2025. Key growth drivers include increasing investments in rail infrastructure, stringent safety regulations, and a rising demand for efficient rail operations. The region's focus on modernization and technological advancements further fuels market expansion, with a projected growth rate of 5% annually.

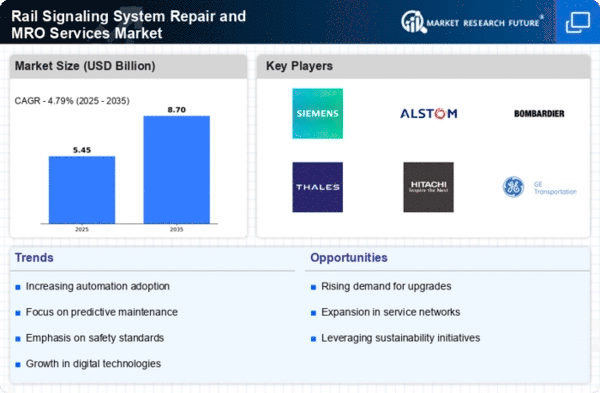

The competitive landscape is characterized by major players such as Siemens, GE Transportation, and Bombardier, who are actively enhancing their service offerings. The U.S. and Canada are the leading countries, benefiting from robust government support and funding for rail projects. This competitive environment fosters innovation and collaboration among key stakeholders, ensuring a sustainable growth trajectory for the market.

Europe : Innovative Rail Solutions Hub

Europe's Rail Signaling System Repair and MRO Services Market is projected to reach $1.5B by 2025, driven by increasing rail traffic and a strong emphasis on safety and efficiency. Regulatory frameworks, such as the European Union's Transport White Paper, advocate for sustainable transport solutions, further propelling market growth. The region's commitment to reducing carbon emissions and enhancing rail connectivity is a significant catalyst for demand.

Leading countries like Germany, France, and the UK dominate the market, supported by established players such as Alstom and Thales. The competitive landscape is marked by innovation, with companies investing in smart signaling technologies. The presence of a well-developed rail network and government initiatives to upgrade infrastructure contribute to a favorable environment for market expansion.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region is witnessing significant growth in the Rail Signaling System Repair and MRO Services Market, projected to reach $1.0B by 2025. Key drivers include rapid urbanization, increasing investments in rail infrastructure, and government initiatives to improve public transport systems. Countries like China and India are leading the charge, with substantial funding allocated for rail modernization projects, contributing to a robust growth rate of 6% annually.

China is the largest market, supported by major players such as Hitachi and Mitsubishi Electric, who are expanding their service capabilities. The competitive landscape is evolving, with local companies emerging alongside established international firms. This dynamic environment fosters innovation and collaboration, ensuring the region's position as a vital player in The Rail Signaling System Repair and MRO Services.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region is in the nascent stages of developing its Rail Signaling System Repair and MRO Services Market, with a market size of $0.1B projected for 2025. The growth is driven by increasing investments in rail infrastructure, particularly in countries like South Africa and the UAE, where governments are prioritizing rail transport as a key component of economic development. Regulatory support and international partnerships are essential for market growth.

The competitive landscape is still emerging, with few key players currently operating in the region. However, the presence of global companies like Siemens and Alstom indicates potential for future growth. As regional governments focus on enhancing rail connectivity and safety, the market is expected to attract more investments and innovations in signaling technologies.