North America : Market Leader in Rail Services

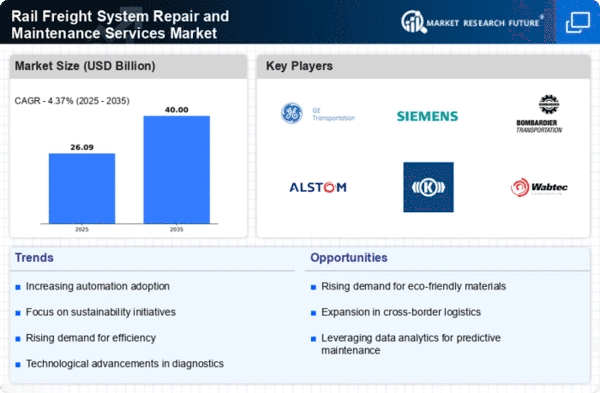

North America is poised to maintain its leadership in the Rail Freight System Repair and Maintenance Services Market, holding a market size of $12.5 billion in 2025. Key growth drivers include increasing freight volumes, infrastructure investments, and regulatory support for rail safety and efficiency. The region's robust logistics network and technological advancements further fuel demand, ensuring a strong market presence. The United States is the primary player in this market, with major companies like GE Transportation, Wabtec Corporation, and BNSF Railway leading the charge. The competitive landscape is characterized by innovation and strategic partnerships, enhancing service offerings. As rail freight continues to expand, the focus on maintenance and repair services will be critical for sustaining operational efficiency and safety standards.

Europe : Emerging Market with Growth Potential

Europe's Rail Freight System Repair and Maintenance Services Market is valued at $7.5 billion in 2025, driven by a push for sustainable transport solutions and regulatory frameworks promoting rail usage. The European Union's commitment to reducing carbon emissions and enhancing intermodal transport is a significant catalyst for growth. Investments in modernizing rail infrastructure and technology adoption are also key trends shaping the market landscape. Leading countries such as Germany, France, and the UK are at the forefront, with companies like Siemens Mobility and Alstom playing pivotal roles. The competitive environment is marked by collaborations between public and private sectors, focusing on innovation and efficiency. As Europe aims to enhance its rail network, the demand for repair and maintenance services is expected to rise significantly.

Asia-Pacific : Rapidly Growing Rail Sector

The Asia-Pacific region, with a market size of $4.5 billion in 2025, is experiencing rapid growth in the Rail Freight System Repair and Maintenance Services Market. This growth is driven by urbanization, increasing trade activities, and government initiatives to enhance rail infrastructure. Countries like China and India are investing heavily in rail networks, which is expected to boost demand for repair and maintenance services significantly. China leads the market, supported by major players like Hitachi Rail and Bombardier Transportation. The competitive landscape is evolving, with local companies emerging alongside established international firms. As the region focuses on modernizing its rail systems, the need for efficient repair and maintenance services will become increasingly critical to support economic growth and connectivity.

Middle East and Africa : Emerging Market Opportunities

The Middle East and Africa region, with a market size of $0.5 billion in 2025, presents emerging opportunities in the Rail Freight System Repair and Maintenance Services Market. The growth is driven by increasing investments in rail infrastructure and a focus on enhancing logistics capabilities. Governments are recognizing the importance of rail transport for economic development, leading to regulatory support and funding for projects. Countries like South Africa and the UAE are leading the charge, with initiatives aimed at modernizing rail systems. The competitive landscape is characterized by a mix of local and international players, focusing on establishing partnerships to enhance service delivery. As the region continues to develop its rail networks, the demand for repair and maintenance services is expected to grow, supporting overall economic progress.