Market Analysis

In-depth Analysis of Radio Transmitter Market Industry Landscape

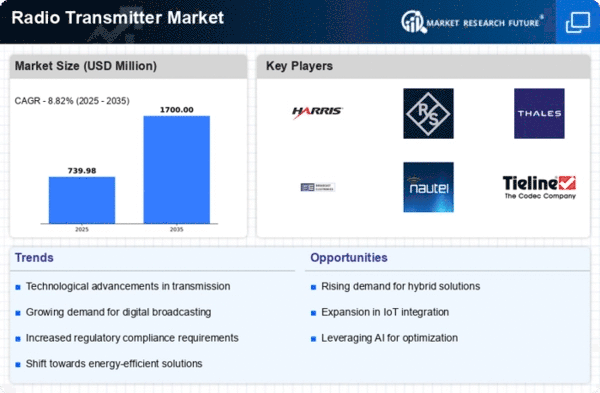

The rapid pace of technological progress is, in fact, one of the main factors propelling market development. In order to adjust with new trends, radio transmitter manufacturers are forced every year to come out all-new items. The need to find more efficient, versatile transmitters has mounted due to the continuing growth in demand for communications systems of all kinds. In addition, the worldwide trend of developing 5G technology has had a particularly profound influence on radio transmitter market. With telecommunications infrastructure facing a huge restructuring to handle greater speeds and information exchanges, demand has grown explosively for medium-and high-grade radio transmitters that can support 5G networks. This surge of demand has affected both radio transmitter market and presented new sales opportunities to players in the field. In addition, the impact of rules and regulations should not be underestimated when considering market trends. As a result, governments around the world have established strict controls over communication equipment quality and safety. These regulations have become important points of distinction for companies as they seek to remain competitive. Another factor contributing to changes in the market is growing consciousness of environmental sustainability. Amid the global struggle with climate change, industry in general and radio transmitter manufacturers in particular are being reminded to green their behavior. With the trend toward sustainability, manufacturers are turning to energy-saving transmitters as a way of keeping up with green demand. Besides these, there is the ever-changing situation in terms of intergroup competition among radio transmitter makers. In addition to the change in overall leadership, mergers and acquisitions as well as more cooperative strategic partnerships between players can also impact market structure. This competitive shake-up stimulates creativity and provides firms with an incentive to keep right on their toes if they want to beat out the competition.

Leave a Comment