Market Analysis

In-depth Analysis of Quantum Dots Market Industry Landscape

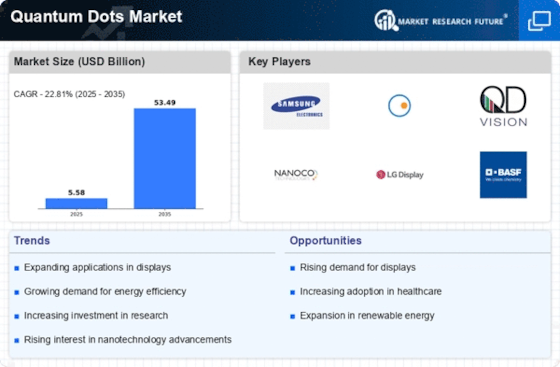

Dynamic and varied market dynamics shape the Quantum Dots Market's growth, competitiveness, and trajectory. These dynamics are driven by rapid technology breakthroughs. Research and development of quantum dot technologies keep the market dynamic. Innovations in quantum dot materials, manufacturing, and applications shape market trends and competition.

Changing consumer preferences and needs also affect the Quantum Dots Market. Quantum dots demand changes as end-users seek improved display technology, healthcare solutions, and energy-efficient lighting. Market actors must adapt to changing consumer tastes to meet their needs. A deep understanding of client needs helps organizations remain ahead and seize opportunities.

Global economic variables affect quantum dot market dynamics. Economic factors, trade policies, and currency fluctuations affect production costs, price, and market accessibility. Quantum Dots Market companies must handle these economic dynamics to stay competitive and resilient amid global uncertainties.

Regulatory factors also affect the market. Governments and regulators shape industry standards, safety, and environmental rules. Market participants must follow these regulations for product development, manufacture, and market entry. Companies who comply with regulations do well in the Quantum Dots Market.

As enterprises compete for market share and dominance, market dynamics are further complicated. Companies innovate to differentiate and improve their products due to intense competition. In the Quantum Dots Market, corporations form strategic alliances, mergers, and acquisitions to gain market share, reach new markets, or acquire complementary technology. New market entries heighten competition and force incumbent businesses to strengthen their strategy.

Environmental sustainability affects market dynamics. The world is becoming more ecologically concerned, thus eco-friendly and energy-efficient technology are prioritized. Quantum dots, which might be used in energy-efficient displays and lighting, are under environmental investigation. In a market driven by environmental concerns, sustainable businesses can gain an edge.

Global pandemics, natural disasters, and geopolitical tensions can also affect the Quantum Dots Market. External forces can disrupt supply networks, production, and demand. Companies must be resilient and adaptable to weather such uncertainty and ensure market stability.

Leave a Comment