Top Industry Leaders in the Quantum Dots Market

Competitive Landscape of the Quantum Dots Market:

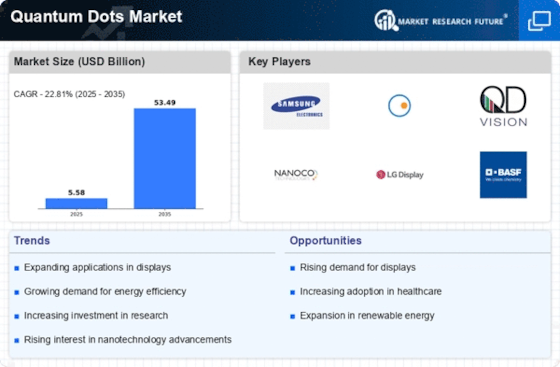

The quantum dots (QD) market, once a niche corner of nanotechnology, is experiencing explosive growth, fueled by rising demand across diverse applications like displays, bioimaging, and solar cells. This burgeoning market attracts both established players and ambitious newcomers, resulting in a dynamic and evolving competitive landscape.

Key Players:

- Samsung Electronics

- Nanosys

- Nanoco Group

- Crystal US Corporation

- QD Laser

- Merck Group

- NanoPhotonica

- OSRAM Licht

- Crystallex Corporation

- LG Electronics

- DuPont

Strategies Adopted by Key Players:

Companies in the QD market are employing diverse strategies to secure market share and gain an edge over the competition:

- R&D Focus: Continuous research and development of new QD materials, synthesis techniques, and applications hold the key to long-term success. Companies like Nanosys and NN Labs are heavily invested in R&D, aiming to create next-generation QDs with enhanced performance and lower production costs.

- Strategic Partnerships and Acquisitions: Collaboration with established players and smaller startups with niche expertise is a common strategy. QD Vision's partnerships with TV manufacturers and Bixbyte's collaboration with leading academic institutions are prime examples. Additionally, acquisitions like Merck KGaA's purchase of Versum Materials provide access to critical technologies and talent.

- Vertical Integration: Integrating manufacturing and supply chain processes offers greater control over quality, cost, and delivery times. Companies like OSRAM are vertically integrating their QD production, while others are partnering with materials suppliers to secure a steady flow of raw materials.

- Sustainability and Environmental Concerns: As environmental consciousness grows, companies are focusing on developing sustainable QD production methods and using eco-friendly materials. UbiQD's green QD synthesis process is a prime example of this trend.

Market Share Analysis:

Analyzing market share in the QD space requires a multi-faceted approach. Traditional metrics like revenue and production volume remain important, but factors like patent portfolios, intellectual property (IP) strength, and regional dominance also play a crucial role.

Established Giants: Leading the pack are established players like QD Vision (Samsung), Nanosys, OSRAM, LG Display, and Merck KGaA. These companies leverage their extensive research and development (R&D) capabilities, robust manufacturing capacities, and established customer relationships to maintain significant market shares. QD Vision, for instance, boasts strong partnerships with TV giants like Samsung and Sony, while Nanosys focuses on diversifying its offerings across displays, solar cells, and lighting.

Emerging Challengers: Disrupting the established order are innovative startups like NN Labs, UbiQD, and Bixbyte. These companies offer differentiated QD technologies, often addressing specific application needs. NN Labs specializes in high-efficiency QDs for solar cells, while UbiQD focuses on sustainable and scalable QD production methods. Bixbyte, on the other hand, is creating next-generation QDs for bioimaging applications.

Regional Nuances: Market dynamics vary significantly across regions. Asia Pacific (APAC) takes the lead, driven by the presence of major electronics manufacturers like Samsung and LG, coupled with a cost-sensitive consumer base. North America holds a strong position due to high R&D spending and early adoption of new technologies. Europe lags behind but boasts a strong focus on QD research and development, particularly in Germany and the UK.

New and Emerging Applications:

The QD market is not limited to established applications like displays and lighting. New and emerging applications are constantly being explored, opening up exciting avenues for growth:

- Bioimaging: QDs' unique optical properties make them ideal for high-resolution, sensitive bioimaging. Companies like Bixbyte are developing targeted QDs for cancer detection and drug discovery.

- Solar Cells: QDs can enhance the efficiency of solar cells, driving down costs and making solar energy more affordable. NN Labs' high-efficiency QDs are paving the way for a new generation of solar technology.

- Security and Sensing: QDs' tunable emissions make them suitable for applications like night vision cameras, quantum cryptography, and biosensors. Companies are actively researching these areas, with the potential for significant market disruption.

Industry Developments

Samsung Electronics:

- December 14, 2023: Samsung Display unveils QD-OLED TVs with improved brightness and efficiency: Introduces new QD-OLED panels with "Hyper Viewing Angle" technology for wider viewing angles and "Ultra Brightness Boost" for increased peak brightness.

- November 10, 2023: Samsung Electronics partners with QD Vision for QD-OLED laptop displays: Collaboration aims to bring high-quality QD-OLED technology to laptops for enhanced color and viewing experience.

- October 26, 2023: Samsung Display showcases QD-OLED microdisplays for AR/VR applications: Develops high-resolution and low-power QD-OLED microdisplays for next-generation augmented and virtual reality devices.

Nanosys:

- January 11, 2024: Nanosys announces collaboration with BOE Technology for QD-OLED displays: Partners with Chinese display giant BOE to develop and manufacture high-performance QD-OLED panels for various applications.

- December 12, 2023: Nanosys receives US$40 million investment from LG Display: LG Display's investment strengthens Nanosys' position in the quantum dot market and supports further QD technology development.

- November 3, 2023: Nanosys wins multiple awards for quantum dot technology: Recognized for its innovative QD technology with awards from The Society for Information Display and Lux Award.