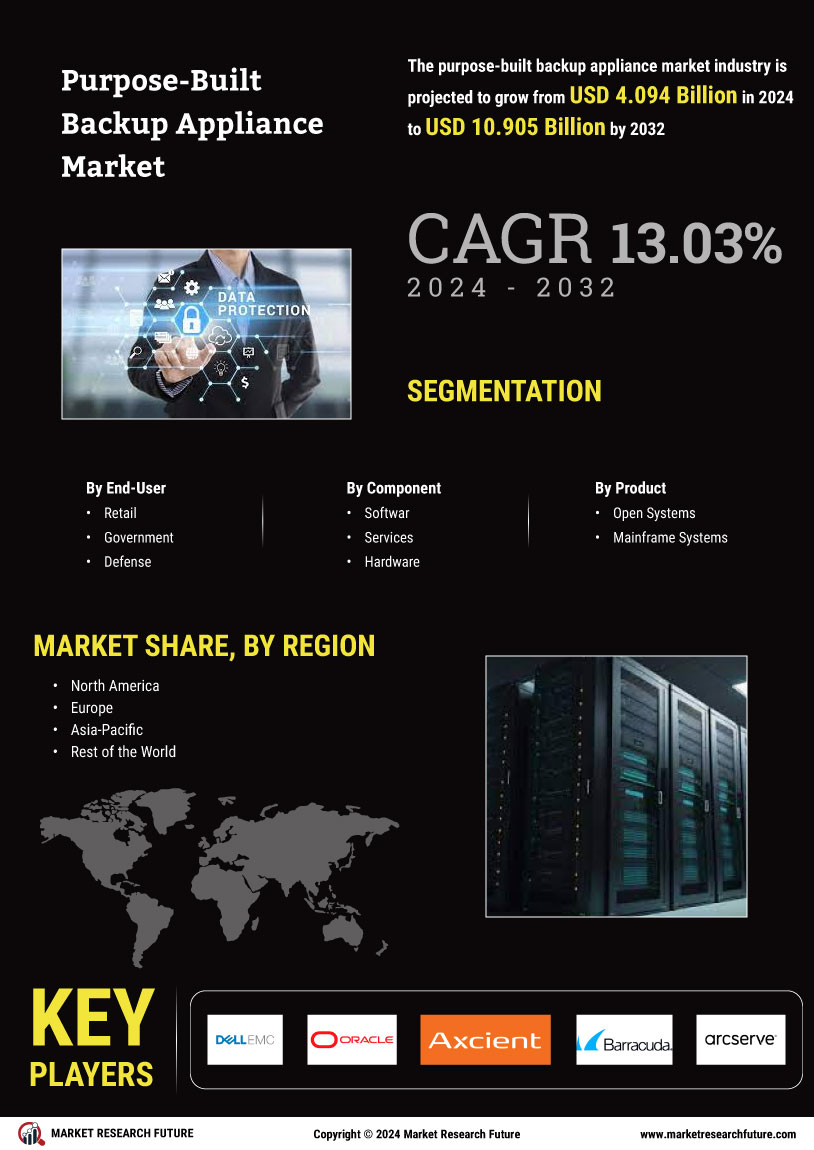

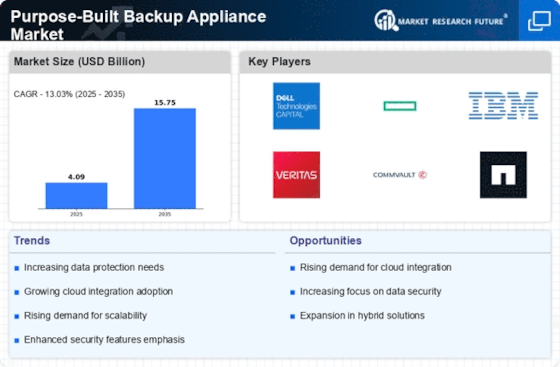

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the purpose-built backup appliance market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, purpose-built backup appliance industry must offer cost-effective items.Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global purpose-built backup appliance industry to benefit clients and increase the market sector. In recent years, the purpose-built backup appliance industry has offered some of the most significant advantages to market.Major players in the purpose-built backup appliance market attempting to increase market demand by investing in research and development operations include Dell EMC (U.S.), Oracle Corporation (U.S.), Axcient Inc. (U.S.), Barracuda Network Inc. (U.S.), Arcserve LLC (U.S.), International Business Machines Corporation (U.S.), Hitachi Data Systems Corporation (U.S.), Commvault Systems Inc. (U.S.), Quantum Corporation (U.S.) and Hewlett Packard Enterprise Company (U.S.).Intelligent solution and cloud-based service provider Hewlett Packard Enterprise Co (HPE). The company's product line includes software, integrated systems, servers, storage devices, networking goods, cloud service-based products, and customized financial solutions. It also offers IT consulting, IT support, instruction, and training services. Small and medium-sized organizations, financial services, healthcare, manufacturing, and telecommunications industries are among the commercial and big enterprise groups HPE serves.

In September three new versions of the purpose-built de-duplicating backup machines in the StoreOnce line, which boost capacity and transfer rates, have been added, according to an announcement from Hewlett Packard Enterprise.Three categories make up the StoreOnce line: 36xx entry-level, 525 mid-range, and 526 high-end. Exagrid, Quantum DXI, and Dell EMC's PowerProtect products are competitors of these systems.Information and data management software programs are offered by Commvault Systems Inc (Commvault). The company provides solutions for data recovery, storage, compliance and governance, and security. The business also provides training, education, real-time support, ransomware recovery, remote managed services, and consultancy for technology. Architecture design, implementation, residency services, personalization, health evaluation, and data migration are just a few technology consulting services it offers. The business provides services to the government, pharmaceuticals, healthcare, and medical sectors, as well as the banking, insurance, financial services, legal, technology, manufacturing, utilities, and energy sectors.