Urbanization and Space Constraints

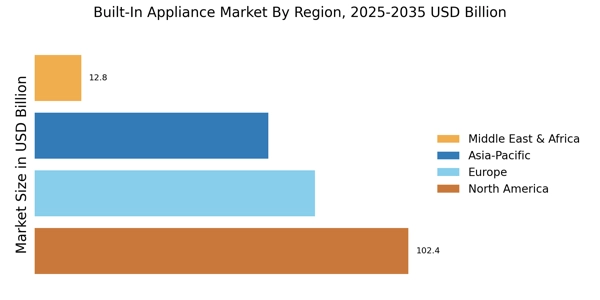

The built-in appliance Market is being shaped by ongoing urbanization trends, particularly in densely populated areas. As more individuals and families move into urban environments, the demand for space-efficient appliances is increasing. Built-in appliances are particularly appealing in these settings, as they maximize functionality while minimizing the footprint. Market data indicates that urban living spaces are becoming smaller, leading to a preference for compact and multifunctional designs. This trend is expected to continue, with manufacturers focusing on creating innovative built-in solutions that cater to the needs of urban dwellers. Consequently, the market for built-in appliances is likely to expand as consumers seek to optimize their living spaces.

Growing Interest in Home Renovations

The Built-In Appliance Market is benefiting from a surge in home renovation projects. Homeowners are increasingly investing in upgrades to enhance their living spaces, with built-in appliances being a focal point of these renovations. Data suggests that the home improvement market has seen a steady increase, with many homeowners prioritizing modern and stylish built-in solutions. This trend is driven by the desire for improved aesthetics, functionality, and energy efficiency. As more individuals undertake renovation projects, the demand for built-in appliances is expected to rise, providing opportunities for manufacturers to introduce innovative products that meet evolving consumer preferences.

Increased Focus on Health and Wellness

The Built-In Appliance Market is witnessing a growing emphasis on health and wellness among consumers. This trend is reflected in the rising demand for appliances that promote healthier cooking methods, such as steam ovens and induction cooktops. Consumers are becoming more health-conscious, seeking appliances that facilitate nutritious meal preparation. Industry expert's indicates that the health and wellness sector is expanding, with consumers willing to invest in built-in appliances that support their lifestyle choices. As this focus on health continues to gain traction, manufacturers are likely to respond by developing innovative built-in solutions that cater to the health-conscious consumer, thereby driving growth in the market.

Rising Consumer Demand for Energy Efficiency

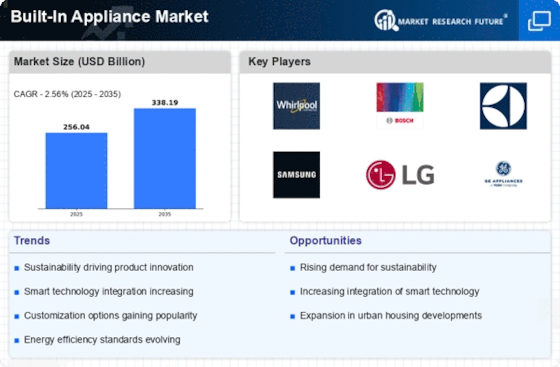

The Built-In Appliance Market is experiencing a notable shift towards energy-efficient products. Consumers are increasingly prioritizing appliances that not only reduce energy consumption but also lower utility bills. According to recent data, energy-efficient appliances can reduce energy use by up to 30% compared to traditional models. This trend is driven by heightened awareness of environmental issues and the desire for sustainable living. Manufacturers are responding by innovating and incorporating advanced technologies that enhance energy efficiency. As a result, the demand for energy-efficient built-in appliances is expected to grow, potentially leading to a market expansion as consumers seek to invest in long-term savings and eco-friendly solutions.

Technological Advancements in Smart Appliances

The Built-In Appliance Market is significantly influenced by the rapid advancements in smart technology. Consumers are increasingly drawn to appliances that offer connectivity and automation features, such as remote control and integration with smart home systems. The market for smart appliances is projected to grow substantially, with estimates suggesting a compound annual growth rate of over 20% in the coming years. This growth is fueled by the convenience and efficiency that smart appliances provide, allowing users to monitor and control their appliances from anywhere. As technology continues to evolve, the demand for smart built-in appliances is likely to rise, reshaping consumer expectations and driving innovation within the industry.