Technological Innovations

Technological advancements are reshaping the Pulp Molding Machine Market, driving efficiency and productivity. Innovations such as automation, artificial intelligence, and advanced control systems are being integrated into pulp molding machines, enhancing their operational capabilities. These technologies not only streamline production processes but also improve product quality and consistency. Recent data indicates that the adoption of smart manufacturing practices is on the rise, with many manufacturers investing in state-of-the-art machinery to stay competitive. This trend is expected to continue, as companies seek to optimize their production lines and reduce operational costs. The integration of technology in the Pulp Molding Machine Market is likely to attract new players and foster a more dynamic market environment.

Sustainability Initiatives

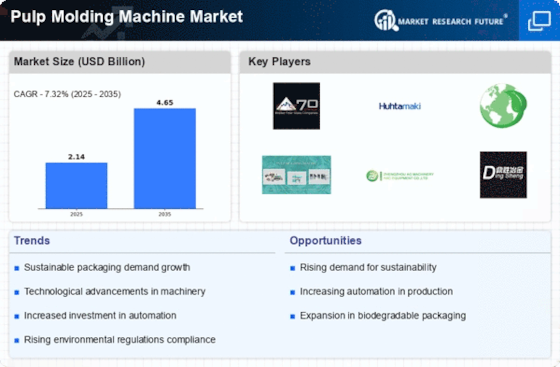

The increasing emphasis on sustainability is a pivotal driver for the Pulp Molding Machine Market. As consumers and businesses alike become more environmentally conscious, the demand for eco-friendly packaging solutions rises. Pulp molding machines, which utilize recycled paper and other biodegradable materials, align perfectly with this trend. In recent years, the market has witnessed a surge in investments aimed at enhancing the efficiency of these machines, thereby reducing waste and energy consumption. According to industry reports, the market for sustainable packaging is projected to grow significantly, with pulp molding solutions playing a crucial role in this transformation. Companies are increasingly adopting these machines to meet regulatory requirements and consumer preferences, which further propels the growth of the Pulp Molding Machine Market.

Rising Demand for Eco-Friendly Packaging

The escalating demand for eco-friendly packaging solutions is a significant driver for the Pulp Molding Machine Market. As industries such as food and beverage, electronics, and cosmetics increasingly prioritize sustainable practices, the need for biodegradable packaging options has surged. Pulp molding machines are uniquely positioned to meet this demand, as they produce packaging materials that are not only recyclable but also compostable. Market analysis suggests that the eco-friendly packaging sector is expected to expand rapidly, with pulp-based products gaining traction among consumers. This shift towards sustainable packaging is compelling manufacturers to invest in pulp molding technologies, thereby stimulating growth within the Pulp Molding Machine Market.

Expansion of E-Commerce and Retail Sectors

The rapid expansion of e-commerce and retail sectors is a crucial driver for the Pulp Molding Machine Market. As online shopping continues to gain popularity, the demand for protective and sustainable packaging solutions has increased. Pulp molding machines are ideal for producing custom packaging that meets the specific needs of various products, ensuring safety during transit. Market trends indicate that the e-commerce sector is projected to grow substantially, leading to a heightened need for efficient packaging solutions. This growth is likely to encourage manufacturers to invest in pulp molding technologies, thereby propelling the Pulp Molding Machine Market forward.

Regulatory Support for Sustainable Practices

Regulatory frameworks promoting sustainable practices are significantly influencing the Pulp Molding Machine Market. Governments worldwide are implementing stringent regulations aimed at reducing plastic waste and encouraging the use of biodegradable materials. These policies create a favorable environment for the adoption of pulp molding technologies, as manufacturers seek to comply with new standards. Recent legislative measures have incentivized the production of eco-friendly packaging, further driving demand for pulp molding machines. As regulations continue to evolve, companies are likely to invest more in sustainable production methods, thereby enhancing the growth prospects of the Pulp Molding Machine Market.